A Chocolaty Opportunity - Hotel Chocolat plc has 2x upside potential

Disclaimer: Bayley Capital is NOT investment advice and the author is not an investment advisor.

All content on this website, in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Listed on the AIM market of the LSE, at the current price of £1.47, I believe Hotel Chocolat plc represents an attractive opportunity to enter the beleaguered retail sector of the stock market at historically low valuations. Hotel Chocolat has been one of the most punished in the UK retail sector even though the company is debt free with cash on the balance sheet and is generating record levels of EBITDA. One of the leading premium chocolate brands in the UK, the company has significant growth opportunities ahead and should return to bottom line profitability by FY24.

Hotel Chocolat came across my radar on the 19thof July when the share price dropped 45% in response to the company’s announcement that it’s expecting to report an IFRS net loss for the year ending 30 June 2022. The loss will come as a result of a strategic review which has led the board to decide to exit the Japanese and US markets, and thus will be recording an impairment charge against the full value of the working capital loan it extended to its Japanese joint venture partner, Hotel Chocolat KK. The share price is down 72% from £5.20 year to date.

Given the dramatic market overreaction, I see an opportunity here to purchase the common stock. I anticipate the market to gain some sense over the next 12-24 months and re-value the common shares to a price 2x greater than current; ~£3, a return of 100% on invested capital, with limited downside exposure.

Investment highlights

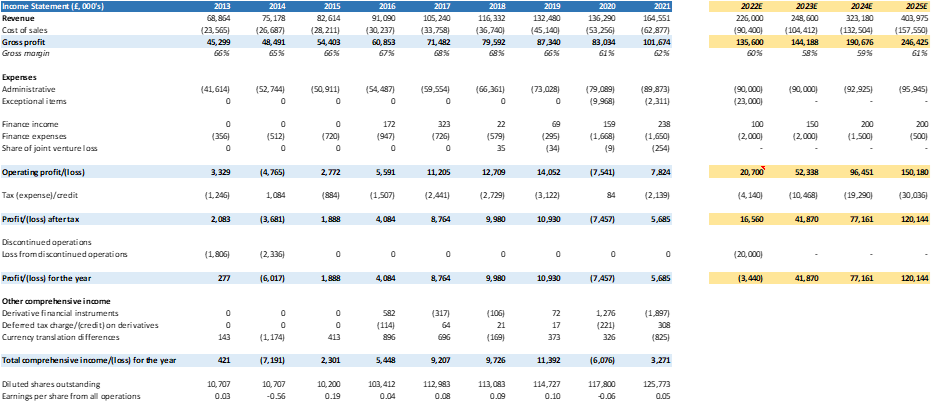

1) Record low valuation with a LTM EV/EBITDA of ~11x, even though the company is expected to report record revenues of £226mm for the financial year ended 30 June 2022 and record EBITDA of ~£40mm with gross margins of ~60%. The current market valuation implies the company will only achieve £8mm of EBITDA for 2022.

2) Founder controlled and operated, Angus Thirlwell the CEO and Peter Harris, the Development Director founded the company together in 1993. They each own 37mm shares each or 27% of the outstanding shares on issue, for a total of 54%. At a share price of £1.47, their share parcels are valued at £66mm each. With such large financial interests in the company, I believe Angus and Peter will run the company to the benefit of shareholders. The value of their shareholding in November 2021 when the shares reached an all-time high of £5.40 was a whopping £200mm. If anyone is feeling the pinch of the current market rout, it’s Angus and Peter.

3) Since listing on the AIM market in May 2016, the company has increased manufacturing capacity at its Cambridgeshire factory. Capacity is currently sitting at £250mm with the option to further double this to £500mm beyond FY23. The latter expansion would be funded via operating cashflows. Furthermore, the company has recently signed a 10-year lease on a second distribution centre in Northampton.

4) Key performance indicators have been trending strongly. Members of the companies VIP loyalty card program, launched in 1H19, are now sitting at 2.3mm users. These customers now account for 71% of UK direct to consumer sales. Loyalty programmes encourage brand ‘stickiness’ and enhance customer lifetime value significantly.

5) Hotel Chocolat is not short of growth opportunities. The directors have expressed their intention to focus on the company’s core UK market and wrap up operations overseas. Overseas operations were hardly ever material, producing only 3% of the company’s total revenue in FY21. Hotel Chocolat operates across three market segments with a total addressable market of between £20 and £30 billion: Gifting, Chocolate, and out of home leisure. The recently launched Velvetiser in home hot chocolate system along with the new liqueur and alcohol range are opening up further avenues of growth.

Company overview

The company is a vertically integrated premium chocolate producer, manufacturing their range of chocolate products from their factory based in Huntingdon, Cambridge. They also produce a small quantity of their own cocoa on their 140-acre cocoa plantation in St Lucia, where they also happen to run a boutique 14 room hotel. Hotel Chocolat are the only independent premium chocolate company listed on the London stock exchange. They sell their products via a network of 96 stores in the UK, with 70% of their sales coming from their website.

The company has a long-standing operating history. Founded in 1993 by two colleagues turned business partners: Angus Thirlwell and Peter Harris. They had their beginnings as a branded mint producer, the type a business would go to if they wanted branded pens, except Angus and Peter focused on mints. Next, they focused on chocolate products under the name “Geneva Chocolates” and pursued the catalogue-based market. Finally, in 2004 they rebranded as Hotel Chocolat and launched their first retail store.

Admitted to the AIM market of the London Stock Exchange on the 10th of May 2016, the company has grown from revenues of £68mm in FY16 to revenues of £226mm in FY21, a compound annual growth rate of 14%. Over the same period, book equity has grown from £6mm to £72mm, or 31% per annum.

So, what happened? / Why is the valuation so low?

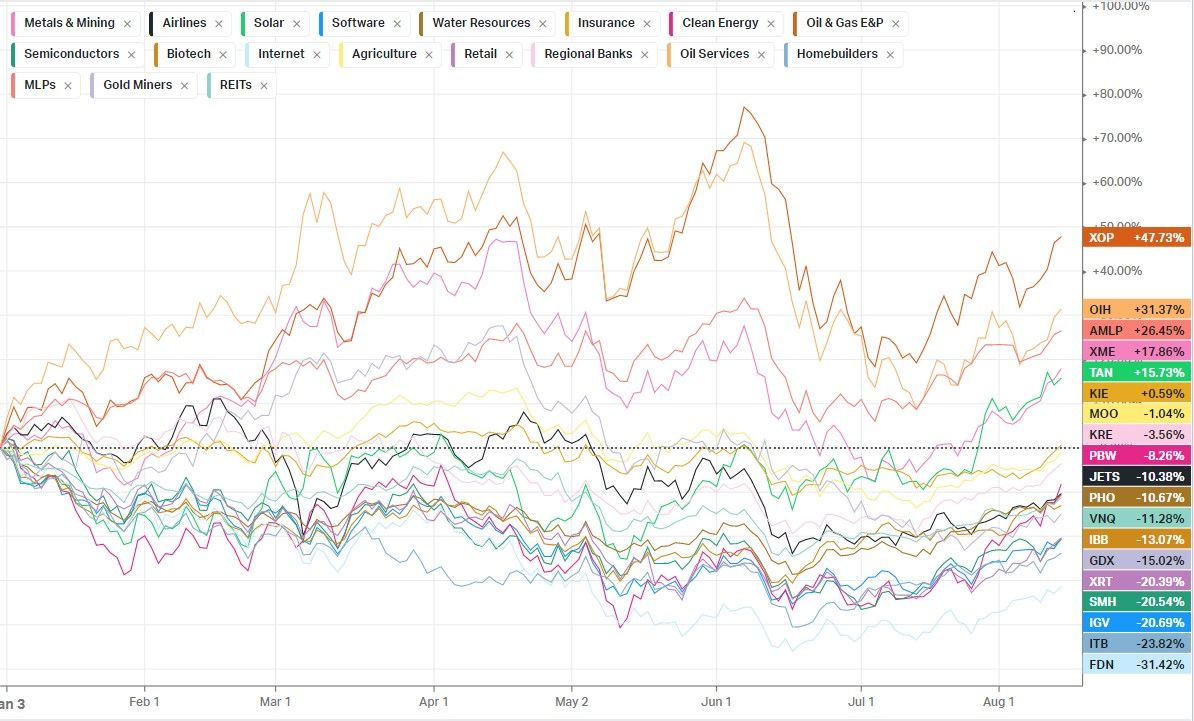

There is no doubt the wider stock market has entered bear market territory in 2022. The tech heavy NASDAQ is down 18%, while the S&P 500 is down 11%. The retail sector is bearing the brunt of the impact as the sector is generally the first that comes to mind when investors think about who will bear the consequences of an economic rout. Inflation prints are the highest on record across the globe in decades as economies wake up from the Covid nightmare to massive supply chain congestion, compounded by massive amounts of liquidity floating around from government handouts and stimulus checks during the pandemic.

The XRT retail exchange traded fund, a good proxy for retail sector stock performance in the US is down 21% year to date, the third worst performing sector of the market. As is typical when Mr. Market throws the baby out with the bath water, smaller capitalization, along with higher leveraged stocks are impacted the most. Case in point and we are presented with the opportunity that is Hotel Chocolat.

Source: Koyfin.com, Bayley Capital analysis

Hotel Chocolat entered the Japanese market during FY18 through a 20% shareholding in the joint venture Hotel Chocolat KK. In the preliminary full year FY22 update announced to the market on the 19thof July, the company stated that it was exiting the Japanese market and thus may record an impairment charge against some or all of the £23mm in working capital loans made to Hotel Chocolat KK over the course of their involvement. Furthermore, on the 27th of July, the company announced that Hotel Chocolat KK gained Japanese court approval to enter into formal restructuring, known as civil rehabilitation in Japan.

The company has been pursuing the Japanese and American markets as an avenue for growth over the past few years. However, they have always held the mantra that entering overseas markets is a strategy that should be pursued slowly and carefully. As such, capital investment in each jurisdiction has been modest, which is further reflected by the small revenue contribution these operations have made to total group revenues; 3% in FY21. Again, a 45% drop on the announcement that these operations were not successful seems like an overreaction.

Covid most certainly prevented these markets building any momentum. The Japanese operations experienced three consecutive peak Valentine’s and White Day trade periods being severely impacted by Covid-related restrictions. During FY21, the joint venture opened 16 stores, bringing the total to 22. Expanding the bricks and mortar retail frontage by 370% during a year of Covid restrictions was clearly not the best strategy. Opening physical stores was probably the right long-term strategy for Japan given the high population density and proliferation of retail malls. However, unfortunately, the timing could not have been worse.

American operations were always largely focused on online and wholesale, with the company only opening four retail stores. Operating via a fulfilment partnership with The Hut Group, the company was able to maintain a capex light operating model while retaining control over the brand, customer base, and strategy. However, a meaningful foothold in the market was never really obtained. Once the last physical retail store in America is closed, focus will become solely on online and wholesale operations.

Company expectations for FY23

The company is expecting operating headwinds to continue through FY23, eventually returning to revenue and profitability growth in FY24. In the July trading update, along with outlining the new strategy of focusing on their core UK market and profitable business segments, the company outlined its expectations of the impact of this adjustment and macro headwinds will have on operating performance:

1) Investment to support the brand will continue. Key to the brand is the further growth of the gentle Farming programme whereby Hotel Chocolats’ farmers are paid a living wage. Management is also committed to paying a living wage in the UK. Management anticipates these measures will result in a 3% permanent increase to operating costs.

2) With the signing of the 10-year lease on the second distribution centre in Northampton, operational in 1H23, the company is aiming to increase unit margins by reducing unit costs. However, this will come with a 3% increase in operating costs in FY23 as the centre comes online and teething issues are worked through. The distribution centre is complimentary to the company’s option to increase manufacturing capacity to £500mm post FY23.

3) Operating costs will increase by 3% as a result of external inflation. However, management believe they can mitigate these cost increases through better procurement and improved production efficiency, driving unit costs down.

The above headwinds total an increase in operating costs for FY23 of 9%, or £10mm based on my estimate of FY22 administrative costs of £90mm. However, management has outlined mitigating steps that they believe will reduce the impact of the above by 3% or £3mm on my FY22 numbers, bringing the net impact of the tailwinds down to £7mm: A focus on marketing to current customers, which is lower cost vs new customer marketing, an increased mix of full-price sales and lower discounting, improved production efficiency and procurement, and scale economies through the increased manufacturing capacity.

FY23 will be a year of adaption, which should lead to a stronger business with lower operating costs and higher margins over the medium to long term. Rather clean out the closet during the ‘bad’ times than the good. The market is not ascribing any value to management astuteness in carrying out manufacturing capacity improvements and further optimisation of the business model. These changes should be highly value accretive to the long-term value of the business. At current valuations the market seems to be implying the company will be in loss making territory for FY23, which is almost certainly not going to be the case. FY22 will deliver circa £40mm in EBITDA with FY23 either in line or moderately higher. Depreciation and amortization will largely be in line with FY22, slightly higher than prior years due to the investment in the factory. Interest expense should largely be in line with prior years or even lower as they intermittently draw on their £50mm overdraft facility. Further, I would not anticipate any non-cash impairment charges given that the impairment to the Japan JV will likely be taken in FY22.

Valuation

At a share price of £1.47 with 137mm shares outstanding, Hotel Chocolat has a diluted market capitalization of £201mm. Deducting the cash balance of £17mm as reported to the market on the 19th of July, the enterprise value of the company is sitting at £184mm. In November, when the shares reached an all-time high of £5.40, the market capitalization reached £740mm or an enterprise value of ~£700mm.

Based on the current enterprise value, Hotel Chocolat is trading at an EV/EBITDA multiple of 11x on a LTM (Last Twelve Months) basis. This is compared to a five-year average for the company of 23x. Based on FY22E numbers, if the market was valuing Hotel Chocolat at 23x EBITDA, the enterprise value would be £1 billion or £7.30 per share, a mere 440% higher than current.

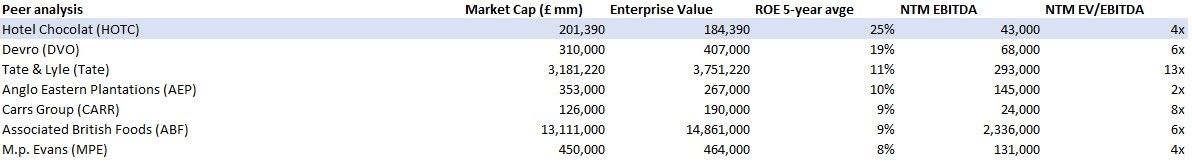

Looking at peer analysis on the LSE, although there are no perfect competitors for this exercise, I have taken the next best option being the food products sector peer group. As you can see from my analysis, Hotel Chocolat maintains the highest return on equity of the group yet sits in equal second place with M.p. Evans with an NTM EV/EBITDA of 4x. Consider that Hotel Chocolat is also only one of two amongst the group with a net cash position, alongside Anglo Eastern. I don’t recommend valuing a company based on peer or industry valuations entirely, although the practice can help put large market valuation discrepancies into perspective.

Source: Bayley Capital analysis

What is interesting to note further is that the company is likely reaching an inflection point with their free cash flow generation. With the expansion of the Cambridgeshire factory during FY21 and FY22, the company will not be investing as heavily into the factory during FY23. They have stated they maintain the option of expanding the factory further post FY23 however this will be funded via operating cash flows. My expectations and clearly management’s expectations as well are that the operating cash flows generated from the increased manufacturing capability will cover the potential cash required for the expansion to £500mm of capacity. This was not the case with the initial expansion where the company raised £40mm in fresh equity in July 2021 to carry out the upgrades.

Ultimately, I think one can deduce that the company has been well run so far. Angus Thirlwell and the wider management team have been good stewards in driving 13% annual revenue and EBITDA growth over the past nine years, while also growing equity at 31% per annum and levered free cash flow at 23%. In terms of looking after shareholder capital, the above performance is indicative of careful and accretive capital allocation. The investment in manufacturing capacity has clearly been a successful enabler of growth. An investment of £40mm of shareholder capital to increase capacity from £150mm to £250mm over FY22 has allowed revenue growth of 37% from £164mm in FY21 to £226mm in FY22. More impressive is the growth in EBITDA jumping from £16mm in FY21 to £40mm in FY22. The EBITDA figures represent a 60% return on the £40mm investment and the £40mm will be completely repaid in less than two years.

On this basis, I don’t believe it’s a stretch to conclude that Hotel Chocolat should command a premium valuation multiple. I anticipate my one-year price target of £3 to be conservative with the hope that the market will re-rate the stock to a more deserving multiple in the region of 20x EBITDA. For illustrative purposes, if the strategy re-alignment is worked through and the company can refocus attention towards growth by FY24, a 20x multiple on estimated FY24 EBITDA of £60mm plus net cash of £50mm, would result in an enterprise value of £1.20 billion, or a share price of £9.

The path to value creation and how we get paid

As I have mentioned, at the current implied valuation the market is suggesting that Hotel Chocolat will cease to generate profits, cease to grow, and will fall off the face of the earth. As I have shown, what I believe is more likely to happen is that the company will face some headwinds in FY23 as it transitions its business to be more profitable. The 45% drop in price on the news of the companies FY23 expectations shows to me that any FY23 headwinds have already been priced into the stock. Therefore, performance in line with these expectations or better should result in a higher share price.

Risks

The key risks I see that may prevent an upwards move in the share price or push the price further down would be, along with mitigating factors:

1) Poor cost management during FY23. Given the company has already announced its performance expectations for FY23, if actual results turn out to be worse, the stock will likely be punished heavily. Given the prudent way management has conducted themselves over the course of being a listed company, I doubt they would shock the market with worse than expected results. Regardless, if operations are not going as smoothly as expected I would anticipate management would forewarn the market.

2) Failure of the Velvetiser. Management has been clear that the Velvetiser is one of the key growth avenues for the company. The market has made it clear that it has high expectations of growth so any further announcements that growth may not be what they expected or a reduction in the total addressable market would not be good for the share price.

Source: Bayley Capital analysis

Member discussion