A foray into the world of junk bonds

Disclaimer: Bayley Capital is NOT investment advice and the author is not an investment advisor.

All content on this website, in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Junk bonds, otherwise known as high yield debt, have always been alluring to me.

The sector has this sense of a ‘cloak and dagger’ arena that only the highly experienced, upper echelons of finance may enter. But if Howard Marks, a friendly, spectacle-wearing man can become a multi-billionaire from a career successfully investing in junk bonds, then surely, it’s not the scary market it’s deemed to be? And so surely us small retail investors could buy junk bonds, and dare I say it, make a market-beating return on our investment?

Well, why don’t we find out? Today I want to delve into the world of junk bonds. I want to go on an explorative journey that results in a number of interesting junk bonds or high yield credit securities that I can take a closer look at, with the hope of finding situations that may lead to further digging, and ultimately, a possible investment.

This is an exercise that I am hoping will bring us all closer to feeling as though accessing these dark corners of the market is not actually so, but rather, is necessary as part of a well-rounded investment portfolio.

If anyone is wondering what a junk bond actually is, it’s corporate debt that is ‘high yielding’ i.e., pays interest that is at least 2 percentage points higher than the equivalent tenure US government bond. In today’s high interest rate environment, bonds tend to be classified as junk or high yield if they are paying greater than 6% annually in interest coupons. When looking at the ‘price’ of a bond however, you look at the ‘yield’ rather than the coupon interest rate. The ‘yield’ considers the coupon rate of interest as well as the price of the bond in relation to the bonds maturity date. For the sake of brevity, I won’t go into further detail, but if you’d like to read more on what constitutes high yield debt, Wikipedia has a nice primer here.

You can buy bonds just like you buy stocks. And, instead of owning a piece of the residual net assets of a company, the company is now indebted to yours truly.

There are a number of benefits to this. First, your financial interest is higher up in the capitalization table or ‘cap stack,’ a term used to describe the hierarchy of stakeholders with a claim on a company’s assets. If you look at a balance sheet, the two sections below assets; liabilities and stockholders’ equity, form the cap stack.

The higher you are in the stack, the greater your legal claim on the assets of the company. Hence, a loan or a bond is higher than the common stock owners of a company, and thus less risky. The creditor (lender) to the business has a stronger claim on the assets of the company if things go pear-shaped and the company enters a form of restructuring or insolvency.

On top of being in a stronger position (both legally and thus financially) if things don’t work out, in the good times you are legally entitled to receive interest payments in the form of a coupon payment. This is in contrast to dividends which are paid to shareholders at the discretion of the board, i.e., there is no legal obligation. Just like a company must pay the interest on an overdraft, it is contractually obligated to pay interest to its bondholders. In special cases, bondholders don’t receive an interest payment. For instance, US treasury bonds do not pay a regular coupon but are instead issued at below par value, so you earn your yield when the bond is repaid at par value. Generally speaking, though, corporate bond issuers pay interest to their bond holders.

Wouldn’t it be nice to receive a regular interest payment, all the while earning >10% per annum?

Let’s get going.

The first step in my search was to set parameters for my screener. I’m using the bond screening tool on FINRA which you can access here. I’ve set the coupon type to ‘fixed’ and have opted for bonds with a Moody’s credit rating of between Caa3 to Ba1. So, I want bonds that are paying out a coupon at a fixed rate of interest, are still junk grade, but are not absolute rubbish in the eyes of Moody’s.

FYI, all bonds are assigned a rating by the big three rating agencies: Moody’s, S&P, and Fitch. They play a major role in the issuance of bonds. When rating a bond, they are determining the investment merits of the bond and the financial strength of the underlying company. The rating will determine the bond’s coupon rate of interest. For instance, Moody’s rates anything from a C to Ba1 as ‘Non-Investment Grade’ i.e., junk or high-yield, while anything from Baa3 to Aaa as ‘Investment Grade’. The lower the grade, the higher the coupon, which is the issuer’s cost of debt. And so, these agencies wield huge power.

I always loved the scene in the Big Short where Mark Baum (played by Steve Carell) and Vinny question the ratings that S&P was issuing to sub-prime mortgage backed securities.

Bed Bath & Beyond

First up, we will look at the January 2024 unsecured bonds of Bed Bath & Beyond ($BBBY), which pay a 3.749% semi-annual coupon and yield a whopping 89% at the time of writing.

I thought I would start with a company that we’re all very familiar with. Plus, I couldn’t resist having a peek at a bond with such an insane yield. When I started writing this article last week, these bonds were trading at a yield of 58%! Suffice to say, the market is feeling a bit spooked right now with JPow and the rest of the western world’s monetary tightening.

We’re all familiar with Bed Bath & Beyond. The way the financial media has been going on about the meme stock craze, it feels like it’s sometimes the only publicly listed company. From a low of $4 at the market doldrums of March 2020 all the way to a record high of $35 last January, $BBBY has seen some crazy price fluctuations as the r/wallstreetbets gang got in on the short squeeze action.

Keep in mind that if you’re looking for a higher regular interest payment, there are plenty of junk bonds paying in excess of 10% per annum in interest coupons. Just be aware of the increased risk. These Bed Bath & Beyond bonds only pay 3.749% per annum in interest but your actual return would be 89% per annum, being the combination of the interest coupon and the capital gain from the current price of the bond to par value of $100 when the bond matures, and the principal is repaid to the bond holders. That is assuming Bed Bath & Beyond stays solvent and makes good on the bond at maturity, of course.

In assessing the investment case of a particular bond, first and foremost we must consider the likelihood the issuing company can meet its financial obligations. They must be able to meet the regular running costs of their business as well as the cost of their capital stack. As in, they must be able to pay the interest on all outstanding bonds and debt, as well as any other financing obligations, while meeting the ongoing running costs of the business. If they can’t meet the former, or there is doubt that they can, I wouldn’t bother spending any more time on the issue. They will be entering restructuring proceedings shortly.

In the case of $BBBY, a yield of 89% is implying that the company is in a severe distressed state and the market does not believe the company will meet its coupon payment and or make whole on the bond when it matures in August 2024. Remember, just like a loan, the principal amount borrowed must be repaid to bond holders on the maturity date. On top of interest, $BBBY will need to re-pay $300m at maturity.

Let’s take a closer look at their financial position.

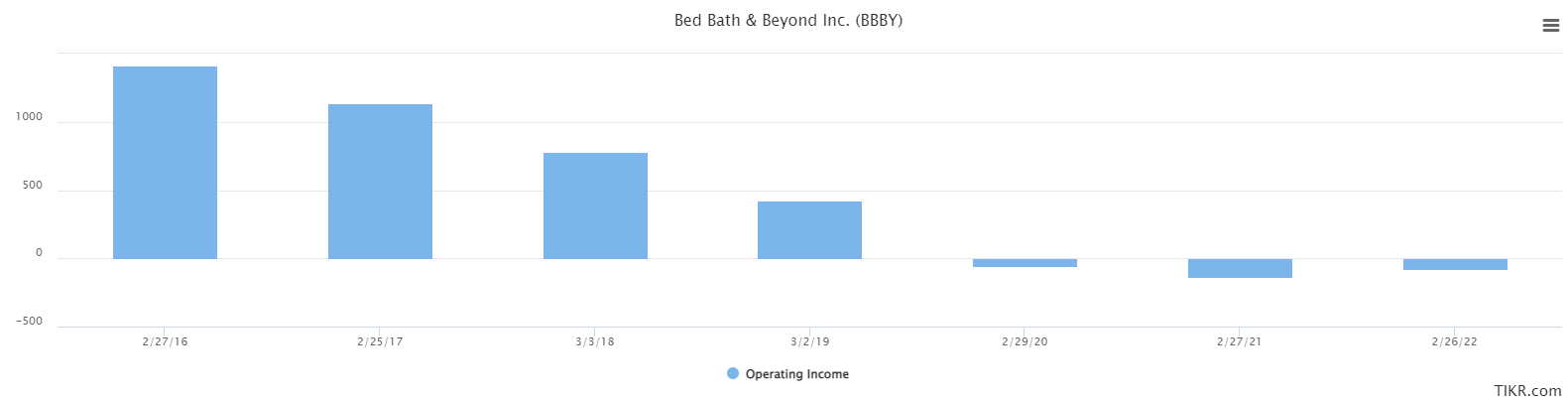

Not so great. As you can see, their EBIT or operating income has been trending downwards quite remarkably since 2019. From nearly $2b to a loss of ~$100m in the latest financial year.

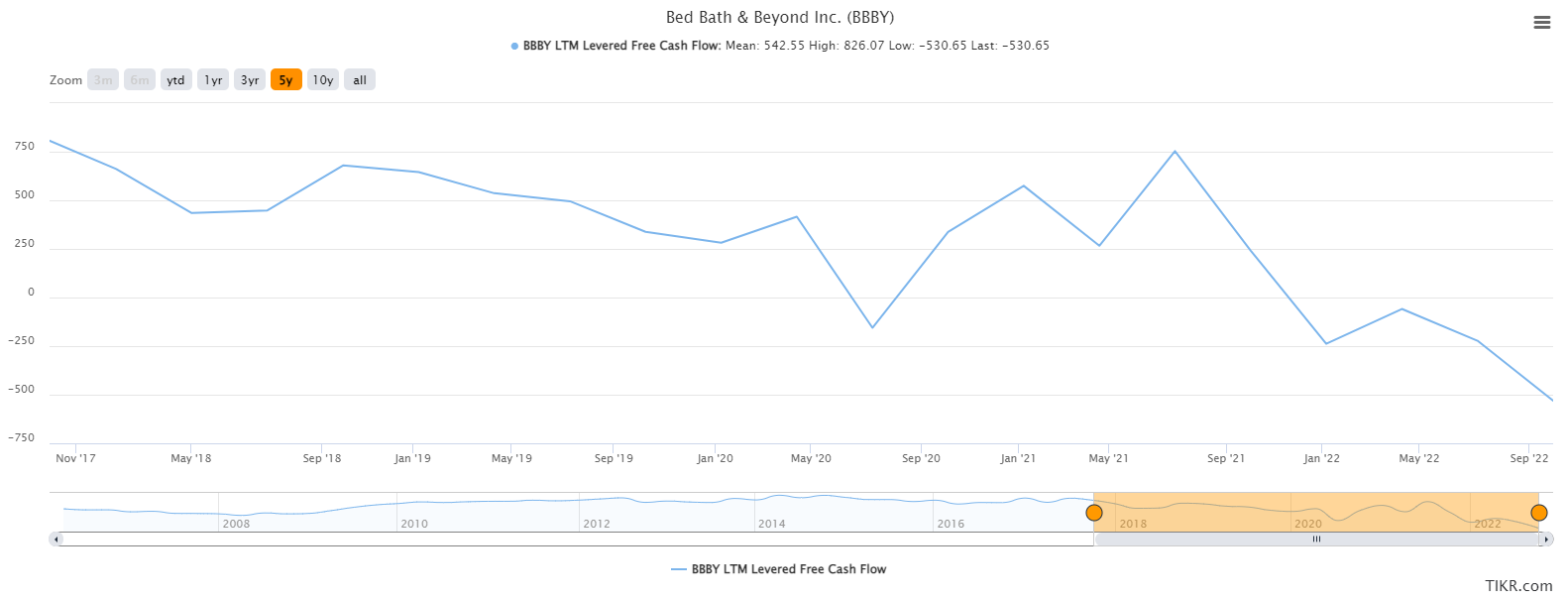

Although profit is important, cash is king when determining debt serviceability. Over the same period, free cash flow has also deteriorated materially. From over $500m in 2019 to negative $722m in the latest financial year.

From looking at these two metrics (and utilizing common sense) I can rule out these bonds as a potential investment. With interest and principal due in 2024 totalling $370m and negative unlevered free cash flow of $650m (free cash flow before interest and principal repayments), I think we would be better placed spending our time elsewhere. The high yield was alluring, but there are clear fundamental issues with the business that put our investment capital in jeopardy. The company is likely in terminal decline.

Capital arbitrage?

Of interest though, there may be a capital arbitrage opportunity here. The current market price of all three outstanding bonds implies a claim on BBBY’s assets of $0.17 cents on the dollar (bonds are trading for a total value of $260m vs par value of $1.5b). The equity on the other hand is being valued at $510m, even though there is no book equity on the balance sheet. The market is therefore implying that BBBY’s future cash flows are worth $510m (given assets are accounted for at fair value). Perhaps the cash flows may be worth something, but I’d posit the debt should be worth more.

Although not an undiscovered trade with a 31% short interest, shorting the equity here may be worth consideration. Although, with markets where they are today and r/wallstreetbets prowling for short squeeze action, I would steer clear. More appropriate may be a long position in the August 2044 bonds, which are being priced at 14 cents on the dollar. With retail investor support, $BBBY will likely raise dilutive equity in the near term. Fresh capital will be a boon for these bonds since serviceability will improve as a result.

I basically ruled out these bonds before even looking at them, but thought I would take a peek anyway. You never know, sometimes you can be pleasantly surprised! I was indeed surprised when I came across the capital arbitrage potential and the 2044 bonds. I may take a closer look at these in due course.

Let’s move on.

With the US 10-year sitting at a yield of 3.7% and inflation around 8%, let’s look for bonds that are yielding greater than 10% but not more than 15%. These would likely be companies that are not in terminal decline like Bed Bath & Beyond, but may be experiencing a short-term blip or are recovering from a tumultuous pandemic trading experience. Hmmmm, cue Carnival Corporation’s unsecured 6.65% bonds due January 2028.

Carnival Corporation

Cruising will be back, I think!

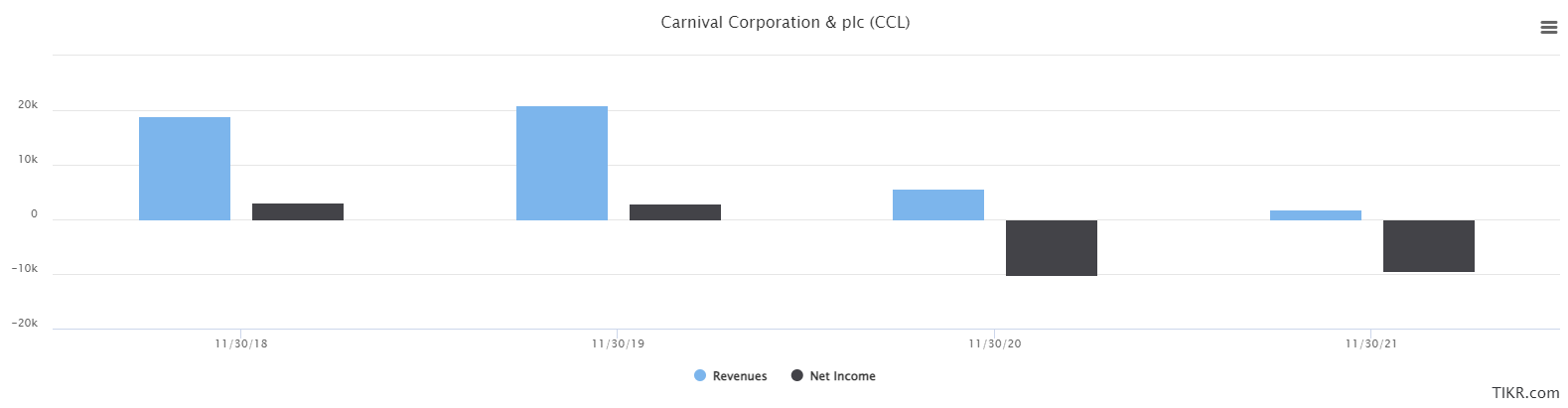

It’s no secret cruising took a massive hit during the pandemic. Take a look at the revenue and net income for Carnival below. Their business was shut down overnight.

Alas, the future is looking brighter. In the last twelve months the company has booked revenues of nearly $6b. This can be compared with the $2b generated in the 2021 financial year, the year most hard hit by Covid. Net income is still down in the dirt at a negative $9b, but prospects seem to be improving.

In August, the US travel association noted that travel spending for the month was roughly in line with July 2019 levels, with 36% of Americans planning to travel over the next three months. In June, Carnival announced that occupancy on their cruise liners was 69%, an increase from 54% in the prior quarter.

Carnival’s financial position is looking as though it’s agreeing with the improving travel market. Cash flow from operations turned positive in the second quarter of 2022 and the company has $7.5b of liquidity in the form of cash on hand, short-term investments, and available borrowings. At an operating cash burn rate of $205m per month over the last 12 months, that gives Carnival 37 months of cash reserves if the revenue tap was turned off tomorrow. Thirty-seven months doesn’t take us to the maturity date of 2028, but shows strong liquidity nonetheless.

With some of Carnival’s nearer term debt in negative yield territory, I think it’s fair to say that the market is giving Carnival’s current financial position the tick of approval. They are more doubtful about these 2028 6.65% bonds, but if the current trend in travel continues, they will most likely be re-paid in full at maturity, all the while netting a nice 14.5% annual return over the next six years.

However, these are not the most enticing bonds of the bunch. I’ll keep them on my watchlist and monitor their progression over the medium term. At this stage, I feel that a rebound in the travel market may not be so clear cut.

Redfin unsecured 1.75% due July 2023

Now, I think I have left the most interesting bonds for last. These are currently yielding 12.7%, paying a 1.75% coupon, and mature next July. Usually, the shorter the duration, the safer the bond. Redfin issued these notes back in 2018 for aggregate proceeds of $144m and have since repurchased $120m worth, leaving an outstanding balance of $24m.

Interestingly, Redfin carries a cash balance of $460m (excluding restricted cash) which provides an exceedingly large cushion to repurchase these bonds either prior to maturity or on maturity in July next year. The $24m outstanding is only 5% of this cash balance.

Considering potential claims on this cash balance that may jeopardize repayment of the bond, Redfin also has 2025 and 2027 bonds on issue, totalling $1.2b. Both of these however are clearly only due beyond the July ‘23 due date of the 1.75’s, so I think we can rule these out.

Could working capital place the cash at risk? It doesn’t look like it. Net working capital is sitting at $319m, so if any of those short-term creditors suddenly need to be repaid, there wouldn’t be an issue. Redfin could either draw on their cash reserves, or more likely collect on their receivables or sell down inventory to make good on a claim.

How about the $157m credit facility? Probably not. The facility is secured against the properties Redfin purchases to onsell for a profit. Even if there was a dramatic crash in the US housing market, the balance of $156m could simply be repaid with cash reserves. Further, the facility is due in August of 2023, after the maturity of the bonds.

Redfin’s business is not in the greatest shape due to the current housing market in the US cooling off somewhat this year, but given the small dollar value of bonds outstanding, plus the short time to maturity, I see these as the best risk/reward of the bunch. I will be doing some more research here and will keep you all posted as to any conclusions I come to.

In summary, assessing the investment case of a bond is similar to that of a stock, albeit you are taking a slightly different angle. Being higher in the capitalization table means the approach is moderately different. All we care about as creditors is whether we get paid or not. Creditors do not benefit or share in a company’s growth, like shareholders do.

I think I have managed to achieve what I set out to at the start of the article. I have found the exercise to be educational and enlightening, I hope the same can be said for my readers.

Thank you for reading. If you have enjoyed what you read, please feel free to share the article with friends, family, and colleagues. If you would like to read more of my work, you can check out my recent article on Hotel Chocolat plc, a vertically integrated premium chocolate retailer with an interesting history and opportunistic future, here.

To follow my ideas and writing more closely, you can follow me on Twitter. I generally tweet about potential ideas before writing about them in depth on bayleycapital.com.

I am really keen to hear from my readers, so please don’t hesitate to send me an email at analyst@bayleycapital.com. I have made a personal commitment to respond to every single email I receive from my readers. I look forward to hearing from you!

☕☕ If you would like to support my work further, you can buy me a coffee here. I am actually a massive fan of English breakfast tea, so that is where these funds will be going instead! 😊.

Member discussion