Deeply discounted REIT likely to liquidate

Disclaimer: The author is not an investment advisor, and nothing they say is investment advice.

All content on this website, in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Asset Plus Limited is a New Zealand incorporated, listed, and focused Real Estate Investment Trust which owns a sub-scale portfolio of three commercial properties in the North Island. The $88mn market cap ($130mn EV) company, which owns a $235mn portfolio, has always been a victim of its portfolio. With modest rental income and capital gains, Asset Plus has struggled to earn a decent enough level of comprehensive income to cover off the bases required to operate a sustainable REIT that generates returns for shareholders: opex, capex, and capital returns.

An un-original victim of the pessimistic office-REIT Covid hangover, Asset Plus’s shares have languished with a depressing discount to Net Tangible Assets in the 40-50% range; currently sitting at 46%.

The company’s total shareholder return since 2008 has been 54%, including dividends. That’s a whopping 3.7% per annum! Remove dividends and the return becomes -49%. Ouch.

Alas, I would not be pouring energies into such a situation if I did not believe there was opportunity on the horizon. The existing three-property portfolio will be no more. One has already been sold (with a two-year settlement – I’ll get to that later), while the board is making plans to list the second this quarter. Lastly, the board will seek “strategic options” for the third and final property, currently under construction, upon completion in the second quarter of the year. What will remain is a debt-free ‘cash box’, and hope for ailing shareholders.

A successful outcome here will require an engaged shareholder base, willing to vote at special shareholder meetings, as we are dealing with significant asset divestitures and a potential liquidation. Unfortunately, I see the current retail shareholder base as relatively “lazy”. Vote attendance was only 24% at a special AGM to externalise the management of the portfolio back in 2017. Poor attendance like this weakens the overall minority shareholders voice, while strengthening that of any motivated large shareholder.

That motivated shareholder is the current property manager, Centuria, who maintains a 20% shareholding and earns its fees (0.5% p.a.) on the property portfolio value, rather than gross assets or cash.

Batting for the minorities, however, is the Accident Compensation Corporation (ACC), New Zealand’s public accident insurer. ACC is new to the register and has been buying up shares since talk of a change of strategy and “assessment of options” talk began. ACC now holds a position of 14.31% and I’d envisage they will be voting for capital returns.

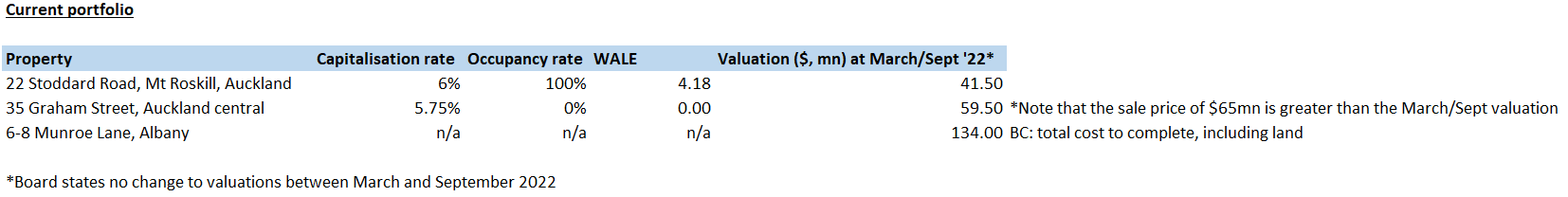

The Portfolio

35 Graham Street, Auckland Central

Situated within the central business district of Auckland, New Zealand’s most populous city, 35 Graham Street sits on prime Auckland real estate. Asset Plus purchased the property in mid-2019, pre-Covid, with the intention of development to enhance the value of the ageing council office that occupies the site. Covid struck before any work could begin and plans were put on hold, along with the company’s wider strategy of “Yield plus growth”.

The property has recently been sold to a well-known New Zealand property developer, Mansons TCLM. The agreement was signed in mid-2022 after Asset Plus shareholders resolved and agreed on the proposed sale. The terms of the sale are not that impressive. Although, given the state of the capital and property markets in mid-2022, the board has probably done a half-decent job here. Manson’s has agreed to purchase the property for $65mn ($6mn higher than the latest valuation) and subsequent to the agreement being signed, paid a 10% deposit of $6.5mn. Settlement is set for December this year, however, at the discretion of Manson’s, can be pushed out by a year to December 2024. Doing so would require an additional 10% deposit (20% total) and would also result in a modest 5% ($3mn) increase in purchase price.

In my opinion, I believe Manson’s will make use of the delayed settlement clause and settle the purchase in December 2024. They’re a developer trying to maximize their return on capital, so any decision made will be dependant on what the market for property development looks like as we near the end of the year. If general sentiment is down and construction costs high, then Manson’s will opt to delay.

Contributing to the current low valuation is the fact that the dividend was put on hold in March 2022 as the lease at 35 Graham St expired. The effect that no dividend has on the company’s equity valuation is exacerbated by the fact that, at present, and as we know, investors can find relatively high, low risk yields in the wider market.

22 Stoddard Road, Mount Roskill, Auckland

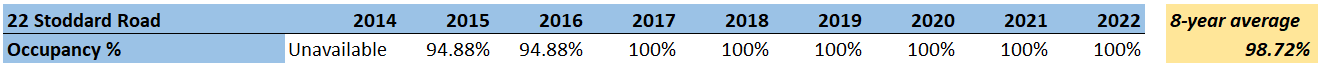

22 Stoddard Road is a large format convenience retail property located in the Auckland suburb of Mt Roskill. Comprising 20 retail spaces and 335 car parks, the property would be comparable to a large ‘Strip mall’ in the US. The property is a stalwart of the Asset Plus portfolio, having been bought back in 2013 when the company operated under the ‘National Property Trust’ name and strategy. Since purchase, Stoddard Road has performed well, generating stable net rental income for the portfolio. The property has enjoyed modest capital appreciation over the period of $10mn (33%).

The property enjoys a solid anchor tenant in The Warehouse – New Zealand’s popular big box retailer. Another attraction to the complex is McDonalds which sits in the corner of the car park (McDonald’s is on a separate title and does not form part of the property). Furthermore, the duopolistic supermarket New World sits adjacent to the site. These stores ensure a steady stream of foot traffic, which has likely been the largest contributor to the property’s strong occupancy rate, which has averaged 99% over the past 8 years.

The board has announced that they are planning on marketing the property for sale in the first quarter of this year. At present, the property is the only earner for the company. Once sold, Asset Plus will have no operating cash inflows and the go forward operating costs of the entity of $5mn p.a. will be met by capital reserves.

The market for commercial retail space in suburban Auckland is strong at present, with Jones Lang LaSalle’s (JLL) latest report stating rents have remained unchanged for the sixth consecutive quarter across all retail property grades. Secondary suburban gross retail rents average $250/sqm (primary at $925/sqm). Stoddard Road compares well with average net rent per square metre of $308. JLL went on to report that given Costco entering the market with the opening of their first store in Westgate, North Auckland, several international retail, and hospitality brands are preparing to enter the NZ market or planning to expand in 2023, bolstering demand for retail space.

On the supply side, Auckland is a narrow inlet intertwined with harbours and coast lines. There simply isn’t enough prime land near the Central Business District (CBD) anymore.

With secondary retail yields softening by 31bps, healthy demand levels, and constrained supply, I don’t see a significant deterioration in 22 Stoddard Road’s March 2022 6% cap rate likely this year. A sale of the property at or near the current valuation will bring the companies debt levels down by 73%, with the balance repaid upon the sale of Munroe Lane or settlement of Graham Street.

6-8 Munroe Lane, Albany, Auckland

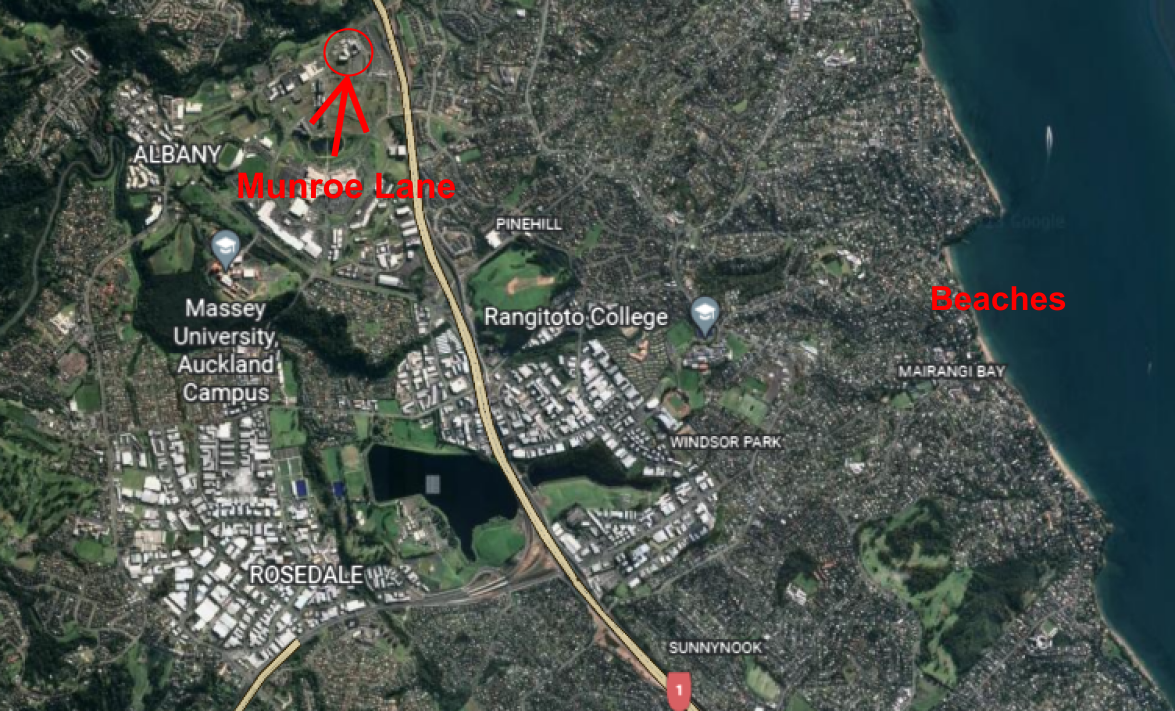

Munroe Lane is a stand out property for Asset Plus and the wider Albany area. Surrounded by road frontage on all four sides, the 6 story, 15,100m2 net lettable area office building, developed in conjunction with anchor tenant Auckland Council, is set to be completed in April of this year. Once complete, the board has stated they will “review its ownership of the property” – i.e., they will look to sell. Asset Plus estimates a total cost of $134mn, with a target yield on cost of 5.5%.

The modern office block has been developed alongside Auckland Council with a 15-year develop and lease agreement. Once complete, the council will occupy 63% of the property (by income). As of late November 2022, the building was 80% complete with level three having already been handed over to the council for fitout. The balance of the floors being handed over monthly thereafter.

With the Council as anchor tenant, Asset Plus has been targeting other government agencies that have pending lease renewals and expiries in 2023 and 2024. However, given the shift to more ‘lifestyle’ office preferences by tenants, Munroe Lane would attract a wide array of prospective tenants. The North Shore is very much a life-style orientated district of Auckland city. The area is famous for its East Coast Bay’s beaches. Albany sits just behind, a mere 5–10-minute drive.

6-8 Munroe Lane is also within walking distance to North Shore’s largest mall, which was completed in 2007 and is set to expand this year. In terms of accessibility, Albany has its own station on the Northern Bus Way, the North Shore’s popular ‘Park and Ride’ public transport system, with Munroe Lane a five-minute walk away. This is an extremely rare position to be in and significantly improves the offices accessibility to both North Shore residents and city siders.

I don’t feel that Asset Plus’s expected cap rate of 5.5% on cost is out of whack. In June 2022, literally the worst time in the past decade for commercial property valuations (ex-Covid Armageddon in March 2020), commercial real estate agents stated yields on North Shore office buildings were between 5-6%. Even if there was a 50-basis point softening to 6%, this would only result in a $11.2mn decrease in sale price; immaterial to the investment case. Fully leased, I don’t see Asset Plus having too much trouble selling this property down.

It’s rare that I get a chance to research a stock that has its operations so close to home. I was fortunate enough to grow up on the North Shore and watched the rapid expansion of the Albany industrial complex unfold before me. Development in the area will not slow down either, with $200mn worth of land bought in the three years to 2020.

A brief history of Asset Plus

Asset Plus was formed through the ‘corporatisation’ of the National Property Trust in 2011. The company operated under that name until July 2018 when it changed its name to Asset Plus Ltd as part of a wider strategic review into company under-performance.

The company has long been a hodgepodge of various commercial properties scattered around the country and has only in the last few years or so reduced the portfolio to its current Auckland focused composition.

The change in composition came through company ructions that took place during the 2017 and 2018 calendar years. In 2017, as a result of poor shareholder returns, the then board engaged the boutique investment bank Northington Partners to review four proposals the company had received for the external management of the portfolio. Of the four, Northington recommended the proposal of Kiwi Property Group (KPG). KPG are an NZ listed landlord and property manager with $3.2bn in direct property holdings and $400mn of property under management.

Another NZ based landlord/manager and shareholder, Augusta Capital (now Centuria NZ) had also been eyeing up the opportunity to turn Asset Plus into a well-performing REIT and increased its shareholding significantly between September 2016 and April 2017 from 9.3% to 18%, just prior to the shareholder vote on the KPG proposal. With Centuria holding nearly 20% of the outstanding shares, its unsurprising the KPG proposal was voted down: 55% of the votes were cast against the special resolution, out of the 24% of the register that voted. Excluding Centuria and Salt Funds (external fund manager) from the vote, 80% of the votes were in favour of the KPG proposal.

At the same meeting, Centuria put forth proposals to remove two of the three directors, including the chair, and appoint the chair of Augusta as the incumbent chair along with two ‘independents’.

Later in 2017, as anticipated, Centuria lobbed their own external management proposal at the board, which was voted in by shareholders in March 2018. As part of the takeover, Centuria worked with the board to review the current business strategy. As a result, they decided a brand refresh was required, along with a change in strategic direction. Centuria and the board agreed on a “Yield plus Growth” strategy that would see the company focus its resources on improving the quality of the property portfolio, alongside portfolio growth. Hence the name change to Asset Plus.

Where to from here

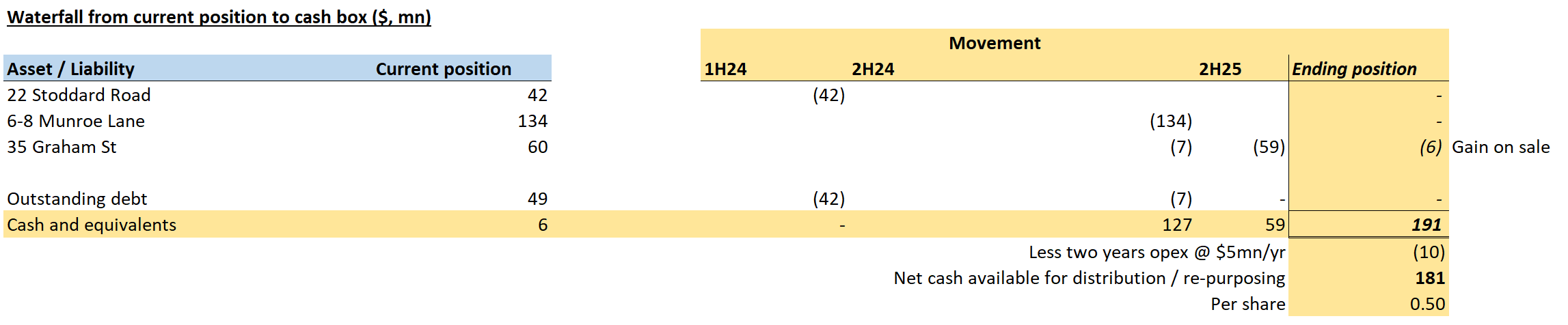

As you can see, the investment thesis is pretty straightforward. Sell down the property portfolio and return capital to shareholders. But of course, as we all know, if management did exactly what we wanted, investing would be too easy.

The good news is that I don’t believe APL has to actually return the capital to shareholders for a reasonable risk adjusted return to be made here. Selling down the properties one by one, will lead to the pay down of debt and eventually the accumulation of cash. In doing so, the execution risk and valuation risk the market is discounting the assets by, will ease.

In plain English, the market should ascribe a higher value to the net assets of Asset Plus, as the risks decrease, and the property portfolio is exchanged for cash. One could also avoid any downward share price momentum resulting from the board deciding to jump back into the property market if you sold out at such a point in time. Again, Centuria is a property management company that earns its fees on the gross portfolio value. Hence, is incentivised to purchase property and grow the value of the portfolio.

I’d envisage the market might value APL in a debt free cash box scenario for 80-90% of NTA. Assuming the $181mn net cash position from my above waterfall, this equates to an equity value of $145-$163mn, or $0.40-$0.45 per share. That implies upside from the current price of $0.24 of between 67% and 88%. If the board decided to wind the entity up and place the company into liquidation, the valuation could edge towards 95% of NTA.

It’s important to note that under NZ tax law, capital dividends are only tax free in the course of liquidation. As such, the board should be encouraged to place the company into liquidation if they are considering a capital return program at all. APL has an insignificant amount of imputation credits (dividend tax credits) that they could attach to any taxable distribution anyway, so under NZ tax law, the dividends would be taxed in APL’s hands at the full 33% Resident Withholding Tax rate.

All property sales require an ordinary resolution of shareholders (50% threshold) to be approved, unless the value of the asset is greater than 50% of the entities assets at the time, in which case a special resolution (75% threshold) would be required. The same applies for any property purchases the board may consider once the coffers are full. I would hope that the retail shareholder base would block any board proposals to re-enter the property market. Again, a reminder that ACC has been buying up stock since talk of the sell down and “assessment of opportunities” talk began and could hold enough of the vote to block any such proposals. At any special meeting of shareholders, if the board does not do so itself, ACC could put forward their own resolution for the liquidation of the company in which, and through the course of, capital distributions could be made.

Disclosure: I do not currently have a position in APL.NZ, however may initiate a position in due course.

Member discussion