A borrowed idea: A bird in the hand is worth two in the bush?

Disclaimer: The author is not an investment advisor, and nothing they say is investment advice.

All content on this website, in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Today’s idea is venturing into the commodity space, a space that has been highly profitable for investors this year, yet an area I have yet to venture into materially thus far. The company in question; Yancoal, is currently earning supernormal profits and cash-flows off the back of record high global coal prices. More importantly, the board seem to actually care about shareholders and will likely pay a ginormous dividend in early 2023. The market seems to have ignored the opportunity largely up until this point, however, seem to be catching on, as the share price has been inching higher recently.

To give credit where credit is due, this idea came across my twitter feed thanks to Jeremy Raper. Jeremy is a highly successful independent analyst, whom I have learnt a lot from over the years. Jeremy maintains a blog over at rapercapital.com where he shares his analysis and thoughts. His work from early 2020 onwards is behind a paywall, with a ~1 year wait list to boot, but you can access his prior work free of charge. He is also a popular writer on Seeking Alpha, where he has contributed nearly one hundred investment theses. Check out his work, I reckon you’ll be impressed.

An overview of Yancoal

Yancoal is an Australian based coal miner with interests in at least nine mines across the eastern seaboard of Australia, stretching from the Hunter Valley in NSW to Middlemount in Brisbane. They also manage the Premier mine in WA near Perth. Based on production, Yancoal is Australia’s third largest coal miner, behind BHP and Glencore. In 2021 they produced 37.5Mt (million tonnes) of attributable, saleable coal and have guided to produce 31-33Mt this year. Heavy rainfall and Covid have impacted this years’ operations, hence the reduced production.

Yancoal predominantly mines thermal coal with some metallurgical coal thrown in as well, about an 85/15 split, and predominantly export their production to Asia utilizing the API5 5,500kCal and NEWC 6,000kCal price benchmarks.

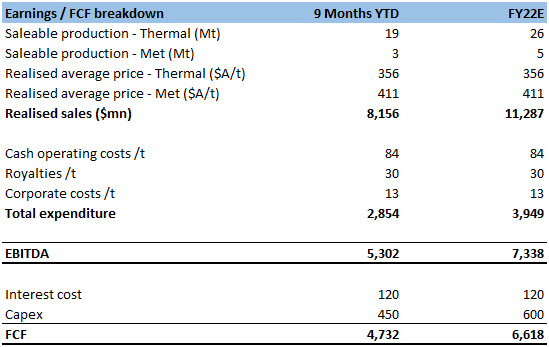

What is interesting about Yancoal is that it is currently trading for less than 1x it’s expected FY23 earnings. With a share price of, call it $6, and 1.324 billion diluted shares outstanding, Yancoal has a market cap of $8bn. With current estimated cash on hand of $4bn, and debt of $700mn, enterprise value comes in at $4.6bn. I’ve estimated EBITDA to come in at around $7.33bn for the full year, meaning the company is currently trading for only 0.63x current year EBITDA.

Yancoal also maintain a dividend policy whereby they distribute the greater of 50% of NPAT or free cash flow. I have estimated free cash flow of $6.6bn for the full year, 50% of which is $3.3bn or $2.50 per share. As $0.52 was already paid in interim during September, I anticipate a dividend of around $2.00/share. That is an eye watering 33% dividend yield (42% total), which based on prior dividend payments, would be delivered to your bank account at the end of April 2023, a mere five months away.

Have I got your attention?

Now, this is obviously a pretty simple thesis: Coal prices are high; therefore, Yancoal are making lots of money and they are going to share this money with their loyal shareholders. But what is also blaringly obvious is that, like with all commodity-based businesses, Yancoal are price takers. Unfortunately, Yancoal have no control over the prevailing coal price. So, while coal prices are extremely high at present, they will of course come down and normalize. It’s a matter of when. For the meantime though, probably all the way through financial year 2023, the coal price will remain elevated enough (>A$250) for Yancoal to profit handsomely. The risk/reward would be entirely unattractive if they did not have a capital allocation policy that showered shareholders with cash.

In terms of the coal market, here is what the company had to say about coal prices in their latest Q3 activities report:

“The GCNewc (NEWC) price remains near record levels; the heavy rain associated with the La Niña weather pattern continues to impact exports from Australia, extending supply-side constraints. The Australian Bureau of Meteorology recently reported that a peak in above-average rainfall conditions for northern and eastern Australia could come during Spring (September-November), followed by a return to neutral conditions early in 2023.

Indonesia has recorded several monthly production records this year and recently produced over 60 Mt per month of coal. Although market shortages are more pronounced in the high calorific value coal markets this year, the lower energy coal from Indonesia is finding customers and appears to be competing with the coal sold against the API5 index (on a value-adjusted basis).

South Africa’s thermal coal exports fell 11% month-on-month in July. Exports were down primarily due to scheduled maintenance on the rail system at the Richards Bay Coal Terminal.

Russian thermal coal output recovered in August; it grew 11% or 1.2 Mt compared to July. However, it remained 14% below the August 2021 output. The introduction of an export duty on coal which the Russian Government is reportedly considering, could result in downward pressure on Russian coal exports for the remainder of the year.

Supply-side constraints only partly explain the international thermal prices. According to the International Energy Agency, the worldwide demand for coal is increasing, and it expects the final figures for 2022 will meet the record demand set in 2013, approximately 8 billion tonnes.

In Europe, favourable economics for coal plants amid extremely high gas and power prices has resulted in increased coal-fired power generation, and fuel security mandates continue to drive coal imports. Conversely, Chinese industrial activity has slowed, with several major cities addressing COVID-19 cases, impacting power generation demand and obscuring the mid-to-long-term demand profile.

All these factors affect sentiment and contribute to thermal coal price volatility in the thinly traded thermal coal spot markets. Thermal coal prices, and particularly high-energy thermal coal prices, seem likely to be well supported for the remainder of 2022 and into 2023. (Emphasis added)

Metallurgical coal indices have fallen in line with declining global steel demand. However, some automobile production has recently resumed in Japan following the increased availability of spare parts, and this may prove constructive for the metallurgical coal price outlook.”

Moreover, with China looking as though its Covid Zero strategy is coming to an end, their incremental demand should bode well for medium term coal prices.

Most of my readers will be familiar with the rise of Whitehaven Coal in recent months. Whitehaven has been the market darling of the Australian coal producers and has taken the front running position on shareholder returns as a result. It is widely accepted in investment communities that Whitehaven has done well off the back of a standout capital allocation policy that prioritizes shareholders – they have already bought back 10% of the register in the year to date and have plans to increase this to 25%.

Of course, Yancoal is not alone in the cohort of Australian coal miners generating record levels of cash, they all are. The reason Yancoal is looking attractive at present however is that on a comparative basis, the company is one of the cheaper stocks of the group. For instance, on an EV per tonne of production basis, Yancoal trades for about $150/tonne. Compare this with Whitehaven Coal that trades for an EV/tonne of $550.

Even when using onerous coal price assumptions going into FY23, it is hard to see how the risk/reward does not look attractive here. After the April dividend, Yancoal will still have a cash balance of ~$2bn. That is before even considering FY23 cash generation. The cash sets the company up nicely for an interim dividend in the 3rd quarter of FY23. Conservatively estimating a dividend of $1, shareholders are set to earn a shareholder return of 45% before accounting for any likely significant capital gains and FY23 cash generation. Taking another angle, the stock can drop to $3.30, and the dividends will mean you will still break even (before tax).

To summarize;

1) Yancoal is currently trading on an annualized dividend yield of ~42%. Isolating the year end dividend pay-out expected in April 2023, the co is trading on a yield of ~30%.

2) The current coal market is tight and is expected to remain so well into 2023. Therefore, it’s expected coal prices (both thermal and met) will remain elevated until such market conditions change.

3) On a comparative value basis, Yancoal is extremely cheap. Trading for just $150/tonne of attributable production compared to Whitehaven, the market darling, trading at $550/tonne.

4) Current year production has been hampered by 33% due to La Niña weather patterns (heavy rain). Yancoal are on track to produce 30Mt of saleable coal, whereas in a good year (i.e. FY23) should produce 40Mt.

If you are interested in digging into this idea further, you can check out Jeremy’s comprehensive twitter thread on the situation here. Otherwise I am happy to answer any queries. Send me an email or leave a comment below.

Wishing all of my readers a wonderful Christmas and New Years break. Here's to healthy(er) looking portfolios in 2023! 🍺🍻🎄

Member discussion