Australian property at bargain basement prices: Australian Unity Office Fund

Disclaimer: Bayley Capital is NOT investment advice and the author is not an investment advisor.

All content on this website, in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Following on from my analysis of Unibail-Rodamco Westfield (AS:URW), the French based owner of Europe’s largest portfolio of Westfield shopping malls, another Real Estate Investment Trust (REIT) has garnered my attention. As you’ll remember from my URW analysis, I presented a list of all the REIT’s listed on the Australian stock exchange, which outlined the current market price of each company’s stock, their latest Net Tangible Asset (NTA) per share, and the discount/premium to NTA that the stock was trading at.

I’ll get to the list soon, but I thought I’d mention; by now, you will have begun to notice a theme amongst my articles/write-ups, being that I tend to focus my attention on companies that I believe are trading at material discounts to their true intrinsic value. It’s not as though this should come as a surprise; I mention it on my ‘Start here’ page and have probably talked about it too much in my writing thus far! For my portfolio, it’s a strategy that has worked consistently over time. There is something inherently comforting about buying a business with a large margin of safety; how ‘cheap’ can real, hard assets and cash flows become in this yield-hungry world that we live in?

With sound analysis, one can get comfortable owning assets that the market deems risky or does not fully understand. Afterall, we have all heard the saying: buy low, sell high. Yet, what is not mentioned alongside, is that buying low requires confidence that you know what you are doing.

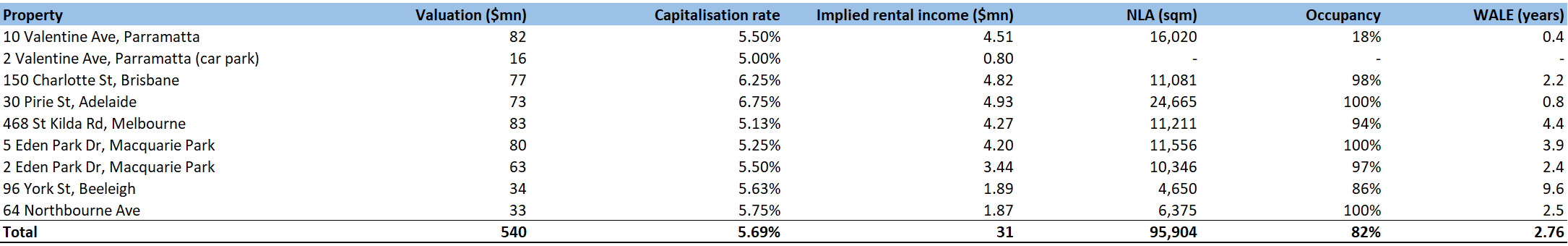

Back to that list. In fifth place was a REIT called the Australian Unity Office Fund (AOF). AOF is a small Australian based REIT that owns a portfolio of eight downtown office buildings, most recently of which were valued at $540mn AUD. The trust currently has a market capitalization of ~$230mn and an enterprise value of ~$400mn. Their properties are spread throughout Australia in well-known metropolitan areas such as Paramatta, Melbourne, Brisbane, Sydney, Beenleigh, Adelaide, and Canberra.

Alas, I believe AOF is trading at a steep discount to medium and long term, conservative estimates of intrinsic value. There are a number of reasons for the discount, and I do believe they are largely warranted, at least in the short-term, however, in my opinion, I believe the responsible entity AURIEL (AOF is a trust scheme, managed by a ‘responsible entity,’ AURIEL in this case) does not need to reinvent the wheel to bridge the valuation gap materially.

I was also intrigued by the considerable corporate activity AOF has been subject to recently. In July, a takeover bid at $2.45/share (11% discount to NTA at the time) from the Aliro Group Property Fund fell through due to the turbulent financial markets, while in January, the proposed merger between AOF and another property fund didn’t cut the mustard according to shareholders and failed at the vote. Furthermore, in 2019, a takeover bid by a consortium consisting of Charter Hall and Abacus Property Group, both fellow property funds, for $3.04 per AOF share fell through. Clearly AOF has attractive assets. At present valuation levels I would posit a guess that a number of funds would be interested in lobbing a bid at the board.

So, why does AOF find itself at the top of the cheapest-of-the-cheap Australian REIT’s?

A few technical reasons to begin with. AOF is a small trust with low trading volume. On average, over the past ten days, only 40,000 shares traded during each trading session. That’s only 0.04% of the float of 88mn shares, as per Yahoo finance. Compare this with the larger cap Waypoint REIT (WPR.AX) which has average daily trading volume of 2mn shares. Stocks with low floats are often laggards of the market as they tend to carry higher technical risk. Low liquidity often pushes buyers to purchase stock at prices higher than they would like, and those wanting to sell stock are coerced into accepting lower bids. This results in high share price volatility. Moves can be dramatic if there are significant demand imbalances; both on the upside, as well as the downside.

Along with poor liquidity, the failed Aliro takeover bid at $2.45/share in July also has technical implications. Aliro was spooked by the rapidly deteriorating market conditions that were seen during the middle of the year. Remember high yield bond yields blowing out to 6%? They’re still relatively high at 4.71% but should mean-revert once markets chill out. AOF granted Aliro extended due diligence twice, yet probably prudently, given the credit market implosion, they could not muster the courage to continue with the acquisition. Alas, there are two outcomes from the failed bid that played on AOF’s share price:

1). Investors flee the stock as it no longer carries the safety net of a marked value, i.e., the takeover price. As a result, the risk premium for the stock goes up. Merger arbitrager's also flee the stock, with significant volume, as their thesis for owning the shares is null and void; there is no arbitrage margin to be collected upon takeover. This was all evidenced by the volume of shares traded on the day the deal was called off, the 25thof July; 840,000 shares traded hands, and the stock dropped 12%.

2). Aliro becomes an apathetic forced seller. As part of their intention to take over AOF, Aliro had amassed a shareholding of 33 million shares (20% of the outstanding shares) which became superfluous after rescinding their offer and were subsequently dumped. Similar to the first point, the heavy selling caused downward pressure on the share price.

We are probably reaching a point where selling pressure has eased, with 6.3mn shares, or 7% of the float, having traded since the deal was called off.

Technicalities do obviously impact how a stock trades and moves, and can help explain short-term price anomalies, however, fundamentals should always prevail in the end. AOF’s fundamentals don’t paint the prettiest picture at present, but as I mentioned earlier, these are relatively short-lived issues that will likely resolve themselves over the medium term. Let me delve into each.

Leases and renewals

During the year, AOF was informed by the tenants of 10 Valentine Ave, 30 Pirie St, and 150 Charlotte St, which make up 50% of AOF’s total leasing space, that they will not be renewing their leases at expiry. For 10 Valentine, AOF’s most valuable property, the lease expiry was on the 30thof June this year, so AOF will not be receiving any rents from this property, until it’s re-tenanted. The lease at 30 Pirie St will lapse in February 2023, while the lease at 150 Charlotte St lapses in June 2024. Based on the latest valuation, annual net rental income for each of these three properties is around $5mn, each property equating to 10% of FY22 total rents, or 30% in total.

A lack of tenancy is not comforting during times of economic flux. Along with these lease expiries, AOF does not have the strongest WALE metric (weighted average lease expiry), coming in at 2.76 years. Strong WALE’s indicate strong rental income and interest expense coverage. The longer the WALE, the more valuable the portfolio. Certainty of cash flow is highly regarded.

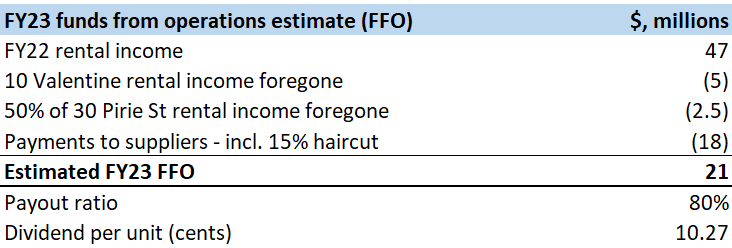

Furthermore, the reduction in rental income will likely lead to a reduction in the dividend payment. If we assume no rental income for FY23 from 10 Valentine, $2.5mn from 30 Pirie (i.e., half), and a 15% haircut to payments to suppliers, commensurate with the rental income reduction, funds from operations could come in around $21mn, meaning a full year dividend of around 10 cents per unit; 33% lower than FY22. AOF has recently stated that the declaration of a dividend will be decided upon on a quarter-by-quarter basis, for now.

Capital allocation risk

Another feature that drew me into AOF were the constant recent affirmations by the fund managers that one of their key strategic pillars is to drive unit holder returns. Generally, that’s the role of a board of directors for a company/trust anyway, but you don’t often hear it come from the horse’s mouth explicitly. Hence, the board have been seeking out strategies to bridge the significant discount the shares are trading for. The takeover bid and the merger proposal were part and parcel. As these have fallen through, the managers have sought alternative strategies.

Most recently, the managers have placed three properties on the market: 150 Charlotte St, 64 Northbourne Ave, and 96 York St. The combined value of the properties at the latest valuation mark was $143mn. The proposed plan for the funds from the sale is to first pay down debt, and then recycle the capital into their refurbishment plans at 10 Valentine Ave and 30 Pirie St.

With dispositions of this size comes risk. First, there is near-term valuation risk. With the last valuation at year end of 30 June, the market is anticipating that the value of these properties has dropped since. Secondly, there is risk that the refurbishment of 10 Valentine and 30 Pirie do not go according to plan: cost over-runs in the current inflationary environment, increasing the scope of the works etc. "The market hates uncertainty more than any known negative."

Technical and fundamental issues combined have lead us to the current all-time low share price of $1.38, and the extreme 39% discount to net tangible assets. The only time AOF traded at such a discount was at the trough of the March 2020 Covid sell-off, reaching a discount to NTA of 47% (as per Tikr.com). Prior to the takeover bid earlier this year, the shares were trading at a discount of around 17% (NTA of $2.76 vs a share price of ~$2.30). Just to put the discount into perspective; at the current share price, the market is implying a capitalisation rate across the portfolio of 15%! That’s a spread of 11.3% against the Australian Govt. 10-year bond yield of 3.7%. That’s banana’s, completely unsustainable, and I believe, will be short lived.

(**edit 28/11/22: the 15% implied cap rate is incorrect and is based on the market cap at the time of $214mn, but should in fact be based on the EV of ~$385mn, which would bring the implied cap rate down to ~7.8%. The spread against the Australian 10-year bond would then come down to 4.1%).

Where to from here?

Management's current plan is to:

- Divest 150 Charlotte St, 64 Northbourne Ave, and 96 York St

- Use the funds received to pay down debt as a priority, while funnelling the rest of the proceeds into the refurbishments of 10 Valentine Ave and 30 Pirie St – the schemes two largest properties by net rental income

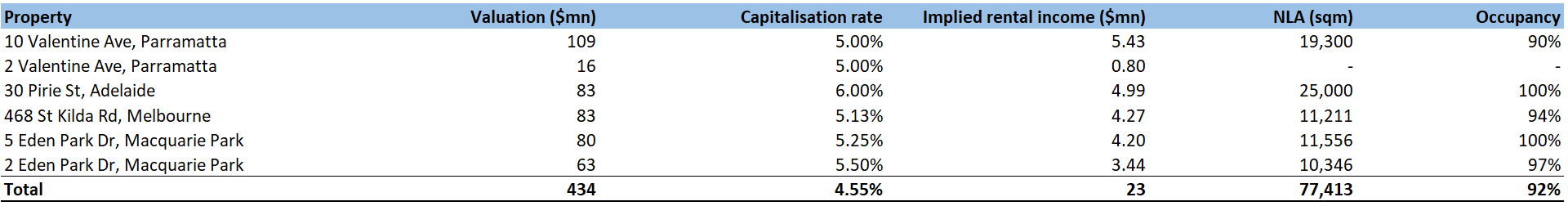

Let’s first calculate what any proceeds from the divestment of the three properties might come to. The combined value of the properties as of 30 June was $143mn (2021: $157mn). Net rental income, as derived by the latest cap rates at 30 June, has been assessed as $4.82mn, $1.9mn, and $2mn, respectively. All three properties have high occupancy rates, strong tenant covenants, and good amenity so I don’t think their market values would have dropped materially since June. For the sake of prudence though, let’s take a 10% haircut off the valuation, to arrive at net sale proceeds of $129mn.

Now that we’ve estimated divestment proceeds, let’s take a look at what AOF might look like post debt repayments and refurbishments at 10 Valentine Ave and 30 Pirie St. With plans approved and construction ready to go, let’s first look at the potential outcomes of the refurbishments. Later, we’ll look at the impact the remaining balance of funds could have on AOF’s debt levels and balance sheet.

10 Valentine Ave, Parramatta

The planned refurbishments at 10 Valentine Ave, Parramatta are to refresh the lobby with third space, create new wellness and end of trip options for tenants, improve services and refurbish the tenancy amenity. That all sounds like gibberish! The way I understand it, they are wanting to refresh and modernise the common areas of the building. They have also lodged an application with the council to reclad the existing façade, which will create additional net lettable area (NLA) of 3,280sqm, or a 20% increase to the properties current NLA.

Assuming the application to reclad the façade is approved, I’ve conservatively estimated the total cost of refurbishment to come in around $20mn. On a lobby of ~700 sqm plus the 3,280 additional square metres the façade reclad would add, the total refurbishment footprint comes in at 4,000 sqm. At a renovation cost of $2,500 per square metre, on the higher end to be conservative as well as catch any inflation headwinds, the total renovation comes in around $10mn. To be assuredly conservative, I have doubled this to $20mn which equates to 25% of the value of the property.

30 Pirie St, Adelaide

At 30 Pirie St, the development application has been approved by the council. The plan is to reposition the property by creating a new canopy at the main entry, refurbish the lobby with a new café, third space, and amphitheatre, with the overall goal to increase the attractiveness of the property while also delivering flexible workspace solutions and sustainability. Taking a similar approach to 10 Valentine Ave, I’ve ascribed a cost estimate of $15mn to the works at 30 Pirie St based on a lobby size of 1,000 sqm and façade improvements. This equates to 21% of the property value.

I have struggled to find evidence that Australian REIT’s spend more than 2-5% of a portfolio’s value in any given year on capital improvements, let alone the 6.5% I’ve provisioned for above.

What the refurbishments mean for AOF moving forward

Now looking at what the $35mn in refurbishments will mean for the value of AOF’s portfolio. I’ve assumed the improvements at 10 Valentine will result in a reduction in capitalization rate of 50 basis points for the property, bringing the rate down to 5.00%, in a normalised environment. If one assumes tenancy will revert to a moderately normal level of 90% based on increased NLA of 19,300sqm, the valuation of 10 Valentine should increase by $27mn to $109mn, or 16 cents per share.

For 30 Pirie Ave, I’ve assumed a reduction in cap rate of 75 basis points, bringing the rate down to 6.00%. Assuming occupancy post renovations comes back to the current level of 100%, and a moderate increase in NLA to 25,000sqm, the valuation could increase by $10mn, or 6 cents per share.

All up, the renovations may result in additional tangible assets of 22 cents per share, bringing net tangible assets to $2.48, for a current discount to NTA of 44%.

Keep in mind that the cost estimates for the refurbishment work, as well as my assumptions on post renovation values are conservative. As a result, you’ll note that the $35mn estimated cost of refurbishment, is only $2mn less than the $37mn anticipated increase in value across the two properties.

In terms of the refurbishments impact on net rental income, I’ve calculated net rental income on the properties to improve by a modest $1mn in total across both properties.

Debt repayments

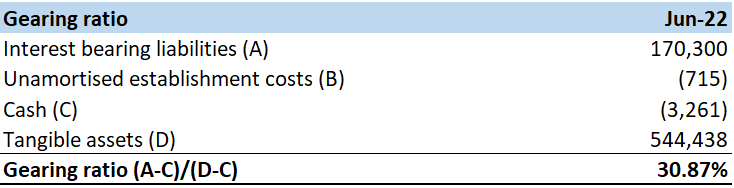

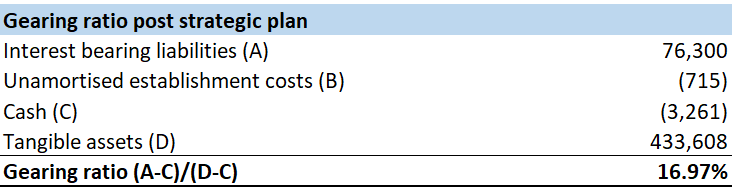

AOF’s current gearing ratio is 30.87%, calculated as interest bearing liabilities less cash, divided by tangible assets, less cash. This is a prudent level of debt, and well within current debt covenants which stipulate a maximum gearing ratio of 50%. AOF’s property values would need to drop 40% to $330mn for this covenant to be breached.

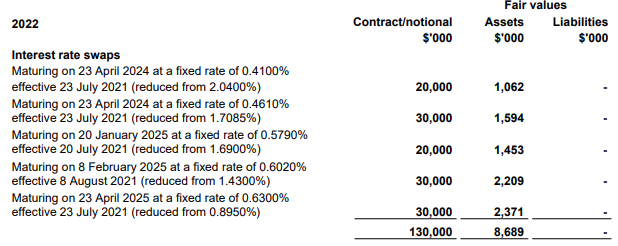

During the global financial crisis, gearing ratios were in the 40-50% range, with some over-leveraged schemes in the 50-60% range. Looking at the most richly valued office REIT on my list, Elanor Commercial Property Fund, they maintain a gearing ratio of 30.8%. Further to these comparisons, AOF maintains an interest rate hedging strategy, with $130mn of their $170mn total debt hedged with rates of between 0.4% and 0.6%. $80mn of the swaps are due to mature in 2025.

Suffice to say, AOF is not over-leveraged and is in a strong position to fight rising interest rates. With the post renovation proceeds of $94mn ($129mn less $35mn), AOF has the option to cut net debt levels to $72mn if all proceeds go towards debt repayments. Doing so would bring the gearing ratio down to a staggeringly modest level of 16.97%.

What could AOF be worth once the strategic plan has been enacted?

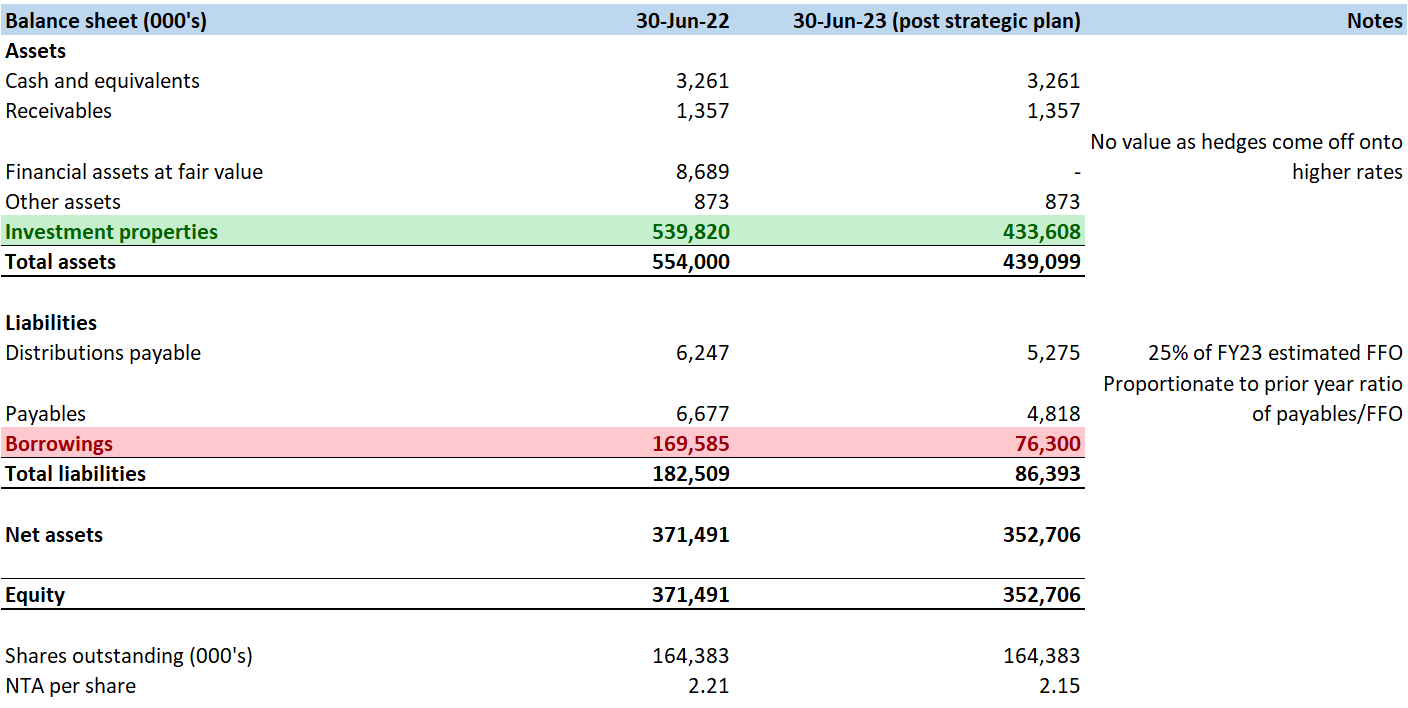

The updated balance sheet is straightforward, as you can see below. With the valuation gains post refurbishment, and reduced debt levels, net assets only decline modestly, even though $143mn worth of property or 26% of the pre-refurbishment property book has been sold.

Assuming refurbishment and debt paydown goes according to plan, the market may look to value AOF at a more realistic, although still conservative, 20% discount to NTA (keep in mind that the Aliro bid, only 6 months ago, was at an 11% discount to NTA). At an estimated NTA of $2.15, that takes the share price to $1.72, or 25% above the current price of $1.38. If the market is really impressed, and values AOF with a 10% discount, that takes the share price to $1.94, or 41% above current. You'll also be collecting a ~7% dividend yield along the way.

In conclusion

Ultimately, there are 100 ways to skin a cat. The outcome here for AOF can take many shapes, however I do think that the strategic plan put forth by management is reasonable. I have tried to be as conservative as possible with estimates and even under such onerous assumptions, the risk / reward looks compelling. In my mind, an investment in AOF would likely entail an investment timeline of two – three years, about the time the strategic plan should be worked through and a conservative estimate on property valuation normalisation.

The above analysis doesn’t take into consideration any normalisation of commercial property values either. When one considers just a 100-basis point shift in capitalisation rates across the portfolio, NTA jumps a whopping $120mn, or 73 cents per share. At a 20% discount to NTA, that would take the share price to $2.35. If you’re interested, I recently read a great article by Cameron McCormack, a portfolio manager at VanEck, who summed up the current commercial property market and why the outlook for Australian REIT’s looks positive.

If the market doesn’t come to value AOF’s assets appropriately, it’s quite likely a buy-out fund in the form of private equity, a fellow property fund, or the like would be interested in taking AOF private. The short-termism of the public financial markets would be no more, allowing the new owner to take full advantage of the long-term value of the portfolio.

It would mean a lot if you let me know if you enjoyed the article with the feedback options below. Please also feel free to comment below and let me know whether or not you agree/disagree with my analysis or have any other feedback.

Member discussion