How not to lend: The expected 49 cent recovery for Carvana’s unsecured note holders

Disclaimer: Bayley Capital is NOT investment advice and the author is not an investment advisor.

All content on this website, in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

Carvana Co, the cash burning second-hand car retailer is on its last legs.

Their cost of equity capital has gone through the roof as their share price has plummeted. Caught between a rock and a hard place, they’ll have to rely on financiers to refinance maturing debt at ever increasing interest rates.

Refinancing is a tough ask when the underlying business has only ever burned cash and performance is deteriorating.

With $5.7bn in unsecured notes, against equity of just $374mn, and assets of $10bn, I thought it would be interesting and timely to take a look at what the unsecured note holders may receive in the likely event of bankruptcy protection.

There are many short reports out there that cover the bear case for Carvana, so I won’t be going too deep down that rabbit hole. But, to shape this article, I’ll give you a taster.

Net losses totalling $2.8bn

Over the course of the past nine years from 2014 to today, Carvana has made cumulative net losses of $2.8bn, on the back of revenue of $40bn. Just under half of this cumulative loss, $1.2bn was incurred in the last twelve months.

Carvana have never turned a profit. That’s strange, considering their share price dramatically rose more than 24x from their 2017 IPO price of $15, hitting $360 in August 2021….

Markets are efficient, they say.

Net debt has grown from $10mm to $7.1bn over the same period

Unsurprising, given the lack of earnings.

In the same vein, Carvana has raised equity totalling $2.9bn since 2014. Current shares outstanding sit at 106mn, compared to the 2017 IPO base of 20mn. Gotta cover those operating losses somehow.

If Carvana wanted to raise equity to repay its nearest maturing unsecured note of $500mn at par, at the current share price of ~$13, they would need to issue 38 million shares. That would come at a dilutive cost to existing shareholders of 36%. Consider, Carvana raised $1bn in 2020 with the issuance of only 18 million shares.

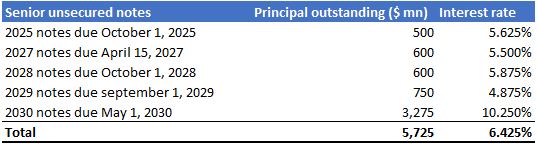

$3.3bn of unsecured notes issued in April with a coupon rate of 10.25%

That’s compared to the rest of Carvana’s unsecured notes that all have coupons around the 5.5% mark. That’s a significant increase in the cost of debt.

These notes are now trading for 52 cents on the dollar, and it only took them six months to get there.

The rest of Carvana’s bonds are all trading in the 40’s, while the 2025’s, their nearest maturing bond, are priced at 64 cents on the dollar.

Second hand car prices are beginning to fall dramatically, while costs are rising

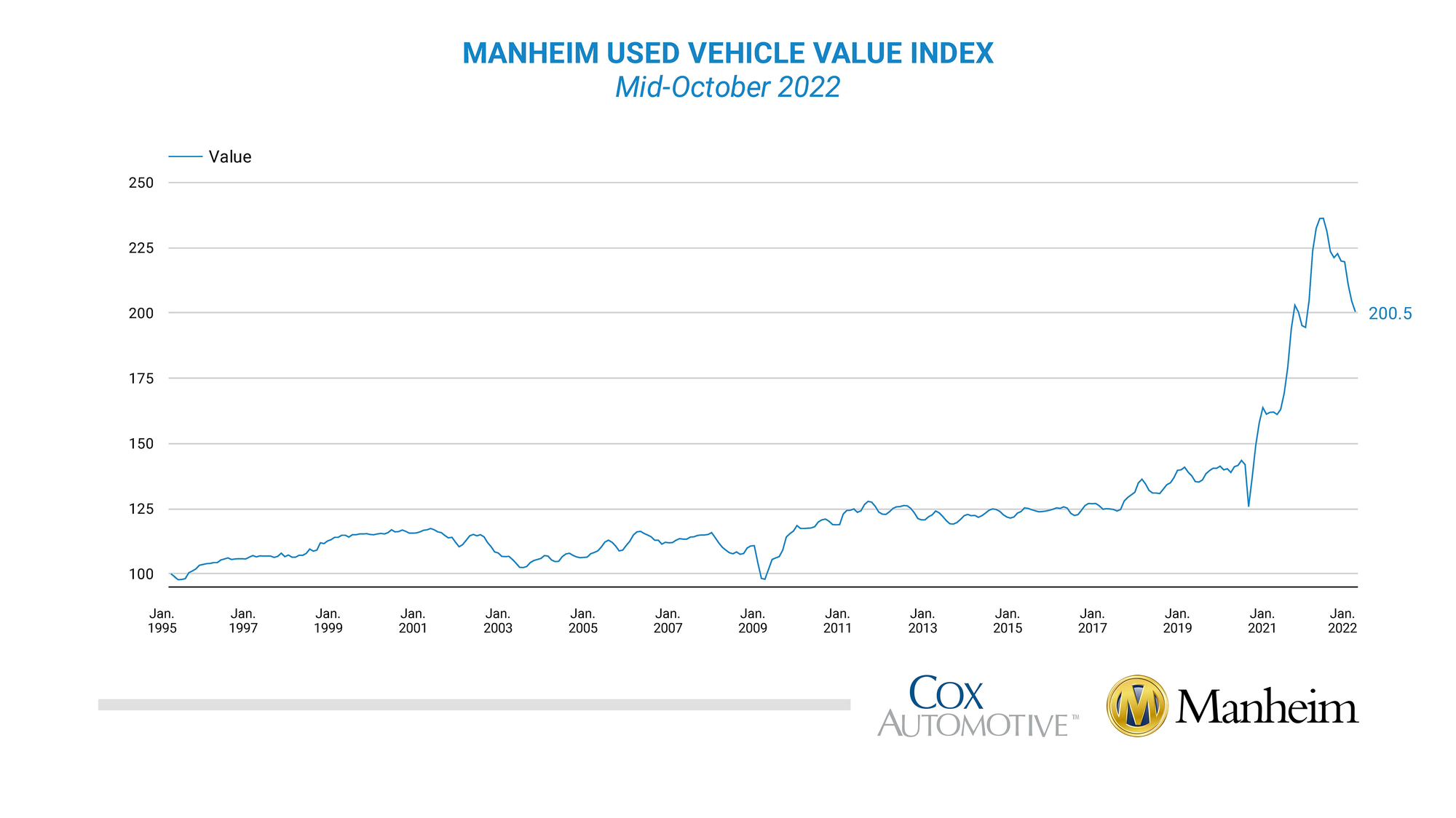

The Manheim used value index, an indicator of pricing trends in the used vehicle market, is down 10.3% to 201, from last October’s 224.

A weaker second-hand car market is further reflected by the decrease in Carvana’s gross profit per vehicle sold, down 25% to $3,500 in the third quarter vs $4,600 in the same quarter last year.

Carvana also famously does not include transport costs in their calculation of gross profit, going against GAAP guidelines, as well as a recommendation from their Auditor.

Selling, general, and administrative costs have increased, as a percentage of revenue, from 21% to 26% quarter over quarter. When you have both gross and operating margins compressing, the acceleration into the corporate graveyard undoubtedly accelerates.

Carvana’s end of life options

With some insight into the distressed position Carvana finds itself, let’s move on to the meat of this science project, estimating ultimate recoveries for unsecured note holders.

Given the poor economics of Carvana’s core business and its reluctance to generate positive cash flows, one needs to assess the recovery value of the company’s assets and how these will flow down to the table of creditors in a fire sale or liquidation scenario.

My understanding is that if Carvana were to seek bankruptcy protection, they would have two options to pursue: Chapter 7, or Chapter 11. Chapter 7 is a liquidation; the business ceases to operate as a going concern, while all assets are realised with the proceeds used to repay creditors as best as possible.

Chapter 11 on the other hand is a ‘reorganisation’ of the company. Creditors come to a compromise and agree to a ‘plan of reorganisation’ put forth by the debtor company. The plan usually involves a haircut to the debt outstanding and friendlier repayment terms. Creditors are compensated by priming the existing shareholders and assuming ownership of the equity. Egregiously, the debtor company would likely seek debtor in possession financing (DIP) (which takes seniority to current debt) to finance its operations for the foreseeable future in the hope of realising greater value for creditors, as compared to a Chapter 7 liquidation.

I do think Carvana would have a tough time arguing that Chapter 11 is the best course, when there is unlikely to be any further value obtained from operating a loss-making business. In addition, DIP financing is senior to all other current debt, so if the situation turns further south, the already beleaguered creditors will receive even less.

Thus, my thinking leads me to believe Chapter 7 liquidation would be the most likely end of life outcome.

The current state of numbers

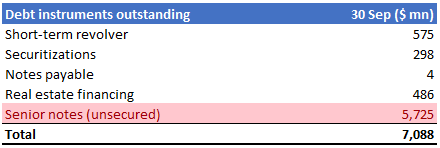

As at the end of September, Carvana had total debt instruments of $7.1bn. All of the $5.7bn senior notes are unsecured, subordinate to the short-term revolver, securitizations, and real estate finance. Meaning, Carvana will need to come up with $1.4bn in realizable assets before the unsecured’s get a dime.

Keep in mind, for the sake of simplicity, I have not included any potential off balance sheet liabilities in my analysis. Warranty claims and/or lawsuits are the obvious contenders, but are both inherently difficult to estimate.

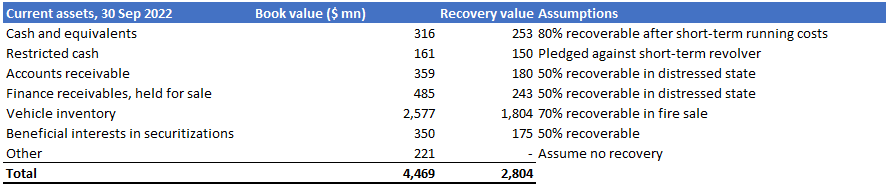

The revolver is secured over inventory, intangibles, and receivables. I’ve estimated Carvana will be able to recover 70% of the face value of inventory in a distressed state. Any buyer of this stock, most likely to be buying in bulk, is going to coerce a significant discount. It would also be prudent to assume used car prices will continue to decline from their unsustainable 2021 levels, for the foreseeable future. At my estimated recoverable value of $1.8bn, inventory will cover Carvana’s $1.4bn of secured claims in full.

Carvana’s trade receivables, which comprise amounts due from customers and their financiers, are at best 50% recoverable. With such a large public presence, it’s likely customers will be well aware of the state Carvana finds itself in and be reluctant to make good on their loans. A third-party receivable financier would therefore also likely value receivables with the appropriate distressed discount and take them off Carvana’s hands for 50 cents on the dollar. I have assumed the same logic for finance receivables and securitizations.

After realising all current assets, secured creditors are covered 2x. We can assume the excess of $1.4bn flows to the unsecured’s, leaving a shortfall of $4.3bn to be covered by Carvana’s non-current assets.

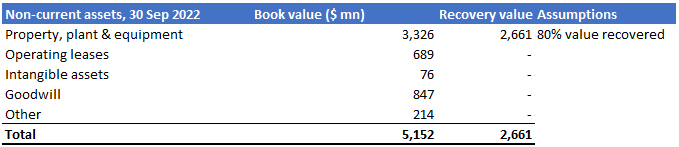

Non-current Assets

As of the end of September, Carvana had non-current assets on their books totalling $5.1bn. Nice! That’s sufficient to cover the remainder of the unsecured notes! Not quite.

I’ve assumed that the only non-current asset worth anything in a distressed situation is the property and plant. I’ve ascribed zero value to the software, furniture, fixtures, and equipment, which make up the balance of the line item. Hence, I’ve ascribed an 80% recovery factor to book value of $3.3bn, bringing recoverable non-current assets to a total of $2.7bn. The property consists of Carvana’s inspection and reconditioning centres, vending machines, as well as property acquired via the ADESA acquisition.

In a liquidation, intangibles are worthless so have ascribed a zero. Rights to the operating lease will revert to the lessor.

Summing it all up, total asset recoveries come to $5.5bn.

After scraping the barrel, the secured note holders are left out of pocket by $1.7bn. Or rather, note holders could expect to receive 70 cents for every dollar they’re owed. That’s not terrible, however, is likely a generous estimate when one considers the bond market is anticipating recoveries in the 40-60 cent range.

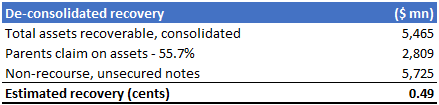

Closing the gap on market valuation

What I have not accounted for in my above analysis is the non-controlling interest that is integral to Carvana’s consolidated financial statements. Carvana Co, the group parent, does not have any operations and is simply a vehicle for holding a 55.7% interest in Carvana Group. Carvana Group is where the economic activity of the business lies. The remaining 44.3% of Carvana Group is owned by the LLC unit holders, largely consisting of the Garcia’s – the current CEO and his father.

Considering that the unsecured debt sits at the parent company level, while the parent only has recourse on 55.7% of the business assets, a quick waterfall schedule helps find the 16-36 cent discrepancy between my estimated 76 cent recovery and the markets expectation of 40-60 cents.

Reducing recoverable assets to the parents 55.7% ownership claim, yields a more realistic estimated recovery of 49 cents on the dollar for the unsecured note holders.

Where to from here

With liquidity of $4.4bn at the end of September, Carvana has the legs to continue operating (conservatively) for the next three years. I’ve estimated this life expectancy with a cash burn rate of $1.5bn per annum, reflecting lower second-hand vehicle pricing and higher go-forward operating costs. This liquidity buffer conveniently takes Carvana all the way to 2025, where they will need to find $500mn for the bond falling due in October, which I somehow think will be quite the challenge.

** Update, 06 November 2022.

After reviewing the third quarter 10-Q in more detail, I believe Carvana is much closer to bankruptcy than noted in my conclusion above. Free cash flow, measured as operating cash flow less capital expenditure was a negative $1.04bn for the quarter. I.e., Carvana may only have four quarters of cash reserves left.

Thank you for reading. If you have enjoyed what you read, please feel free to share the article with friends, family, and colleagues. If you would like to read more of my work, you can check out my recent article on Hotel Chocolat plc, a vertically integrated premium chocolate retailer with an interesting history and opportunistic future, here.

To follow my ideas and writing more closely, you can follow me on Twitter. I generally tweet about potential ideas before writing about them in depth on bayleycapital.com.

I am really keen to hear from my readers, so please don’t hesitate to send me an email at analyst@bayleycapital.com. I have made a personal commitment to respond to every single email I receive from my readers. I look forward to hearing from you! 👋👋

Member discussion