Europe’s largest shopping mall owner: A de-leveraging story turning the dividend back on

Disclaimer: Bayley Capital is NOT investment advice and the author is not an investment advisor.

All content on this website, in the newsletter, and all other communication and correspondence from its author, is for informational and educational purposes only and should not in any circumstances, whether express or implied, be considered to be advice of an investment, legal or any other nature. Please carry out your own research and due diligence.

As the markets continue their tumultuous run, I continue my search for deeply undervalued businesses that can provide shelter for capital over the medium to long term.

The Fed is continuing their walk down tightening lane and it’s likely they will continue to do so until they see blood on the wall; pain in the markets and tempering inflation.

We all know the pain has begun, the S&P500 is down 25% year to date. I can feel it in my bones.

I continue to remind myself that these are the markets that provide opportunity. Maintain a long-term investment horizon, and the rewards will come.

In today’s article, I take a look at Unibail-Rodamco Westfield, Europe’s largest shopping mall owner and operator.

As a bottom-up investor, I don’t usually look for sectors that are out of favour with the market, or that come across my desk as ‘cheap,’ in order to find compelling investment opportunities. However, I have recently started to notice many sectors have become just so.

You’ll recall in my August article on Hotel Chocolat, I was finding many retailers trading at or near bargain level valuations. Hotel Chocolat is still trading for just 4x its expected FY22 EBITDA, which is expected to have grown in excess of 100% from the previous financial year. Retail valuations continue to decline with the XRT retail ETF down a further 14% since early August, for more than a 35% decline year to date.

As an extension to the retail market, commercial property valuations have also taken a dive during 2022. VNQ, the Real Estate Investment Trust (REIT) ETF, is down 33% year to date.

Anything that isn’t energy related has gone down this year.

In this sort of economic environment, I am inclined to prefer sectors that have real asset backing.

Real assets perform well during inflationary times. For instance, returns on capital for landlords improve as rents on retail space are increased at rates greater than the increase in running costs (generally speaking). Furthermore, companies that own real estate necessary to their operations harbour a lower cost of capital due to the lower lending risk associated with their real asset backing.

And thus, I began taking a look at companies with property-heavy balance sheets. Tiring of trying to understand many of these companies' operations, I turned to the commercial property sector to focus my energy on ‘pure’ property without the operating baggage.

I started looking for REIT’s or corporate landlords whose stocks were trading at significant discounts to their net tangible asset value.

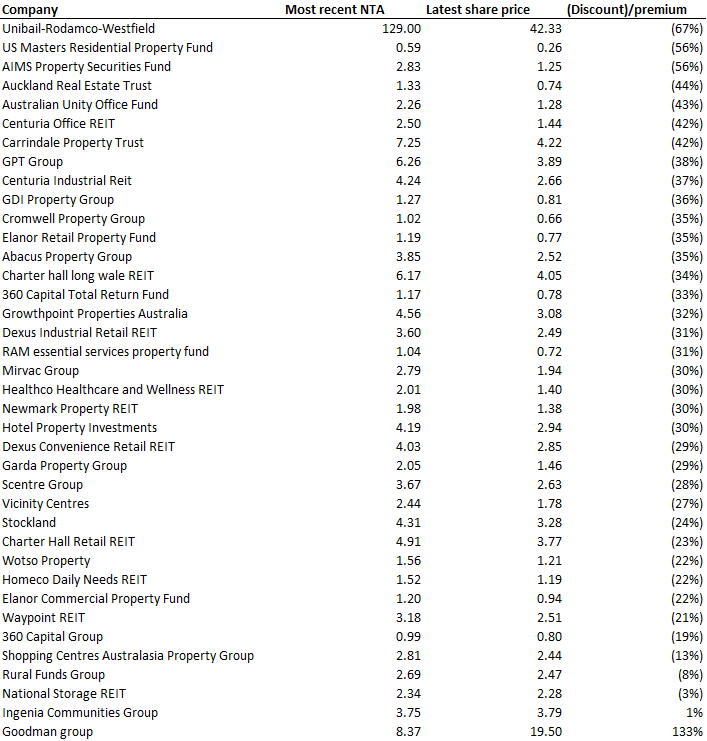

As part of my discovery, I took a look at the Australian market. Being a rather inefficient market, coupled with the YTD decline in the sector, I wasn’t surprised to see a large number of these companies trading at less than 70% of NTA (net tangible assets).

What I was not expecting to see was the largest owner of malls and shopping centres in Europe with €40B worth of property on its books, Unibail-Rodamco Westfield, at the top of the list, trading at just 33% of last reported NTA. Unibail listed in Australia under a CDI structure (which are fungible with Unibail’s stapled shares) after their purchase of Westfield in 2018.

I’ve included a screenshot of my spreadsheet of Australian-listed REIT’s and corporate landlords below if anyone is interested in doing further digging. You can also access and download the spreadsheet here.

When I look for investments, I am not only looking for an underlying low valuation. Although an irrefutably core component of the search, it’s a mere starting point. Catalysts that invoke upward share price momentum are crucial. After all, a company can remain cheap for its entire life. The low valuation must be an opportunity rather than a threat to my capital.

In that vein, Paris-based Unibail-Rodamco Westfield looks to be an enticing situation at present.

An overview of the current situation

- Unibail’s equity is priced as though the company does not have any terminal value; that is, the market is implying the value of its property portfolio is going to zero in the long term. As of the 30th of June, Unibail’s net asset value was €143 per share. With an equity price of €41 at yesterday’s close, the market is pricing Unibail’s net assets at a 71% discount.

Unibail owns 82 malls across Europe and the US. At present, they are working through a disposal programme of €4bn of their European portfolio, which they are 80% of the way through. They are also selling their entire portfolio of American shopping centres, which were valued at €13bn at the end of June. As such, there are clear markers communicating to the market that the property portfolio does in fact have value.

Poor capital allocation over the past few years has cast doubt across the market that management can manage their capital prudently. I believe this to be a key reason for the significant discount.

-

Unibail is not falling foul to the usual relaxed corporate boards that one tends to come across in Europe. With two high profile activist shareholders on board, Xavier Niel and Leon Bressler, who recently blocked a proposal by the company to issue a fresh €3.5bn in equity, the company is being steered down a path that should result in returns to these activist shareholders, with minorities in tow.

-

The company is heavily indebted with €31bn of debt on its books and a loan to value ratio of 41%. Promisingly, the complete disposal of their portfolio in the US, along with the European disposal programme, is part of a wider strategy put forward by Xavier Niel and Leon Bressler to reduce their debt levels.

Rising interest rates should not impact Unibail materially with the group’s debt fully hedged for the next five years, along with cash and available securities of €12bn. A 2% increase in rates would only impact Unibail’s recurring earnings by €16.3mn.

-

Unibail is targeting a return to pre-Covid net rental income and group EBITDA by the 2024 financial year. In the 2019 financial year, the company generated net rental income of €2.5bn, suggesting the company is currently trading at just 2.4x its expected 2024 NRI. Positive signs emerged in the first half of the 2022 financial year with net rental income of €912mn, and only a -€187mn movement in the value of their assets, suggesting property valuations have stabilized.

-

The company has announced it will be reinstating its dividend in the 2023 financial year. Assuming a conservative pay-out ratio of 75%, the board may elect to pay a dividend of €7. At the current share price of €41, this would equate to a dividend yield on cost of 16%. If we assign the long-term average dividend yield of 6% that Unibail has traded at over the past seven years, a dividend of €7 per share would equate to a share price of €112.

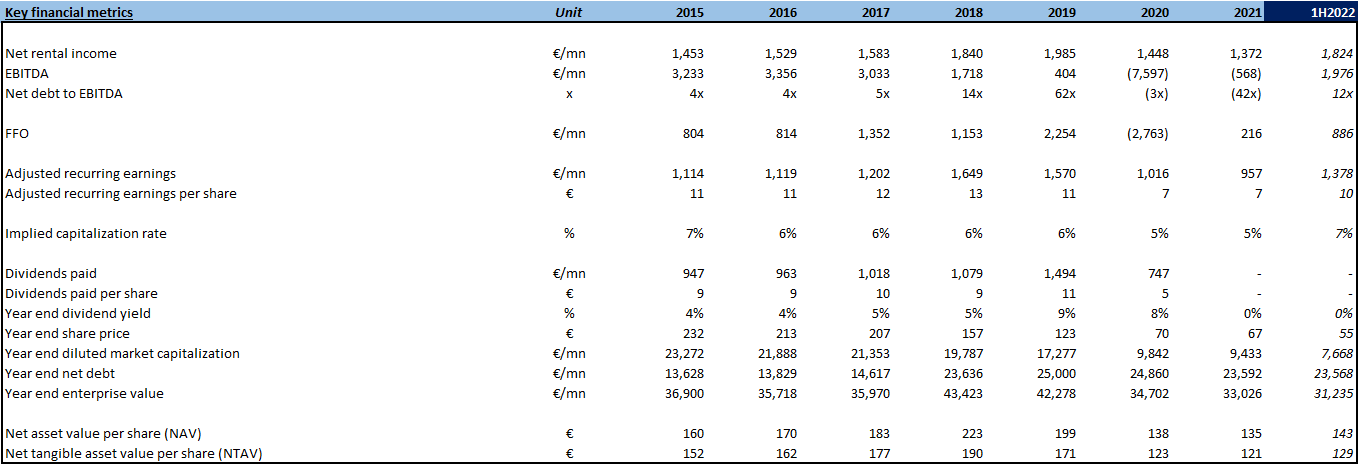

Again, you can access and download the spreadsheet containing the below key financial metrics, along with seven years of historic financial statements, here.

A brief history of Unibail

The path to becoming a behemoth property landlord did not follow a straight line for Unibail. A mishmash of entities, the group is a product of the merger of two companies and an acquisition of a third: Unibail, Rodamco, and Westfield.

Unibail merged with Rodamco in 2007 to become Europe’s largest publicly traded property company. Then, in 2018, Unibail-Rodamco purchased the Westfield Corporation for total consideration of €25bn, which included 35 shopping centres in the US and UK, to become the present Unibail-Rodamco Westfield.

There are a number of Westfield-branded shopping centres in Australia and New Zealand, although these were not included in the acquisition.

As of the end of the first half of the 2022 financial year in June, Unibail had an interest in 82 shopping centres spread across Europe and the US, valued at €40bn.

Unibail derives 75% of its net rental income from its European malls, the balance coming from the US.

From peak rental income of €1.9bn and earnings per share of €11 in 2019, Unibail suffered dearly over the course of the pandemic. Rental income in 2021 dropped to €1.4bn, while adjusted recurring earnings per share fell to €7, due to €6bn of cumulative valuation impairments on their property portfolio, amongst other things.

Activist investors on board

During the struggles of 2020, Unibail’s board proposed to raise €3.5bn in fresh equity capital via a rights issue to shore up the company’s balance sheet. Such a capital raise would have indeed aided the company in its struggles during the pandemic. However, it also would have massacred the value of existing shareholders equity by 33% overnight.

Usually in these situations, the capital raise is approved by shareholders as the board does not put forth alternative methods of financing for shareholders to vote on. Fortunately, in this case, two of the largest shareholders on board, Xavier Niel and Leon Bressler, were not happy with the proposal and successfully scuttled the plan.

Xavier and Leon used their influence to encourage the board to instead sell down the US portfolio and use the proceeds to pay down debt. As part of the shuffle, four directors (of twelve) resigned, and a new CEO, Jean-Marie Tritant was implanted to carry out the new strategic plan.

At the time of the rebuke, Xavier and Leon jointly owned 5.1% of the groups outstanding shares. As it stands, Leon has divested of his interest which was owned via his hedge fund, Aermont Capital. Xavier has increased his holding to a material 27% of the outstanding shares on issue. The value of Xavier’s shareholding has only moved one way, currently down 41% on his cost basis. He should be pretty motivated to ensure the board carries out its strategic plan.

An American fallout

The US malls included in the acquisition of Westfield have proven to be a thorn in Unibail’s side. Having suffered a significant drop in value over the pandemic, the company is currently busy working to offload these assets in full, as part of their new de-leveraging plan.

Their flagship US portfolio includes properties such as the Westfield World Trade Centre, Westfield Century City and Westfield Garden State Plaza. These are premium properties that should attract strong valuations in a normalized post-Covid environment. Currently, these assets command cap rates of between 4% and 7%.

The remaining US assets include Westfield shopping centres spread throughout regional United States. Given their location and makeup they command lower valuations, with cap rates in the range of 6% to 8%.

Having paid a total $15.7bn for these assets in 2018, they were most recently valued at half year for €13bn, a 33% drop in value.

Promisingly, post-Covid, the US malls have been performing well. Unibail reported at half year that tenant sales across their US properties were at 106% of 2019 levels, driven by their flagship locations. Rent collection was 94% in the first half, vs 91% in 2021 and 70% in 2020. Although immaterial in absolute terms, in the first half of the year, Unibail sold a development parcel in the San Fernando Valley of California for $150mn, or 60% more than the last appraised value.

The market has punished Unibail for the acquisition

Comprising 33% of Unibail’s property portfolio, and 25% of the groups IFRS net income, the US assets constitute a significant chunk of Unibail’s financial interests. As such, and given their drop in value since purchase, it’s unsurprising the market has not been inclined to congratulate them for their work here.

One can think about the discounted share price as an increase in the implied cost of Unibail’s equity capital. The lower the share price, the more dilutive an equity raise becomes.

“Hey, if you are going to buy assets and then sell them for less than you paid, we will provide you with capital, but it will be at a much higher cost.”

Capital allocation is an important aspect of any corporation, but especially so for a company that derives its earnings exclusively from a capital-intensive real estate portfolio.

Upon acquisition, Unibail’s debt levels ballooned by €10bn, while the malls have not contributed to the groups bottom line at all. Between 2018 and 2019, net rental income increased by €100mn, which was completely wiped out by an increase in head office costs of €110mn. On top of the poor operational performance, the US debt comes at a higher cost of 4% per annum, vs an average of 2% per annum for the European debt.

Although the disposal of the US assets is occuring at a time when their value has dropped below their purchase price, it is ultimately a step in the right direction for Unibail. Among a host of benefits to the company, they will now be able to refocus their energy on their European business, which is where the company’s history and expertise lie.

In terms of the impact the US disposals will have on Unibail’s earnings, it’s important to note that the valuation impairments of the US assets have been recorded in the accounts over the four and a half years since purchase. European REITs report under IFRS and thus investment property is accounted for at fair value. Under US GAAP, investment property is accounted for on a historical cost basis. Hence, any sale, assuming they take place at (or near) the last appraised value, will have a negligible effect on the net income of Unibail, while any (unlikely) valuation upside between the June half year and date of sale is retained by the company. Recorded as a gain on sale above book value, the additional earnings will be accretive to URW’s bottom line.

As the disposal programme moves forward, free cash flow to equity will increase by the quantum of interest foregone on the paid-down debt, foregone principal repayments, and the reduction in go-forward maintenance capital expenditure. I’ve estimated interest on the current US debt amounts to be approximately €200mn per annum. Maintenance capex has been more difficult to calculate, but I estimate it sits in the range of €100mn to €200mn. And hence, levered free cash flow to equity should increase by €300mn, bringing the funds from operations (FFO) yield to about 20%.

On the balance sheet side of things, the sale of the US assets won’t have an immediate impact on URW’s leverage position. However, the impact should be reflected over time, as the value of their retained property portfolio increases, reducing the company’s loan to value ratio.

Even though the US assets will likely be sold at a discount to their initial purchase price, the board, thanks to Xavier and Leon, are taking steps to rectify their American mistake. The market should eventually appreciate that this will result in a stronger business moving forward and reward the company with a higher share price and lower cost of capital.

The path to value creation

With uncertainty likely to be the major economic theme across the world over the medium term, it’s unlikely that Unibail’s property portfolio will be the driver of shareholder returns. As mentioned earlier, the equity markets do not hold faith in management’s ability to manage capital. Therefore, I posit that the successful completion of the European and US asset divestitures will significantly improve the company’s standing with the market.

However, in my opinion, the biggest boon will actually come from the re-instatement of the dividend. An announcement of an interim dividend, to be issued when the company reports full year 2022 results in the first quarter of next year, should provide significant upwards momentum to the share price. All throughout the pandemic, and as recently as its investor day in April, Unibail has stated their intentions to resume paying dividends in the 2023 financial year.

Over the past eight years, Unibail has paid out a total of €6.2bn in dividends to its shareholders. Its investor base is thus largely comprised of dividend and yield seekers, and hence this base will finally have a reason to purchase Unibail shares once again.

Historically, Unibail has paid out more than 85% of its adjusted recurring earnings per share to shareholders via an interim and final dividend. In their 2021 annual report, the company stated they will resume paying a dividend “at a significant and sustainable pay-out ratio,” which was reiterated at their April investor day, where they again mentioned paying a “sustainable” dividend for 2023.

In the 1H2022 results presentation, management guided to adjusted recurring earnings per share of “at least” €8.90. Assuming a "sustainable" pay-out ratio of 75%, the board could elect to pay a dividend of €6.70. At the current share price of €41, this would equate to a dividend yield on cost of 16%. Even with high yield credit spreads blowing out, you would struggle to find such a yield elsewhere in the market.

If we assume they remain consistent with their 85% pay-out ratio, the dividend jumps to €7.60, for a yield of 18%.

Working backwards, and applying the 6% historical average dividend yield Unibail’s equity has traded at over the past seven years; a dividend of €6.70 would imply a share price of €112, while a dividend of €7.60 implies a share price of €127.

In summary

Ultimately the business of owning and operating malls is not one that I would generally find attractive. However, in this instance I find the quality of Unibail’s assets to be appealing.

Although the economic outlook across the globe is looking uncertain, the significant margin of safety provided by the large discount to net asset value provides a sense of comfort. Most importantly, the reinstatement of the dividend in the not-too-distant future will provide a significant catalyst to drive the value of the equity higher and bridge the valuation gap.

At present, given my portfolio is already fully invested, I will not be taking a position in Unibail. However, pre-dividend, it remains a compelling opportunity that will remain on my shortlist.

Thank you for reading. If you have enjoyed what you read, please feel free to share the article with friends, family, and colleagues. If you would like to read more of my work, you can check out my recent article on Hotel Chocolat plc, a vertically integrated premium chocolate retailer with an interesting history and opportunistic future, here.

To follow my ideas and writing more closely, you can follow me on Twitter. I generally tweet about potential ideas before writing about them in depth on bayleycapital.com.

I am really keen to hear from my readers, so please don’t hesitate to send me an email at analyst@bayleycapital.com. I have made a personal commitment to respond to every single email I receive from my readers. I look forward to hearing from you! 👋👋

Member discussion